Compare Strategies

| PROTECTIVE COLLAR | LONG STRANGLE | |

|---|---|---|

|

|

|

| About Strategy |

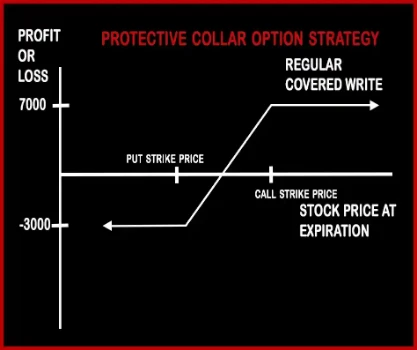

Protective Collar Strategy This Strategy is implemented when the investor requires downside protection for the short - to medium term but at lower cost. Buying protective puts can be an expensive proposition and writing OTM calls can defray the cost of the puts quite substantially. Protective Collar is considered as bearish to neutral strategy. In this strategy risk and reward is both are limited. This |

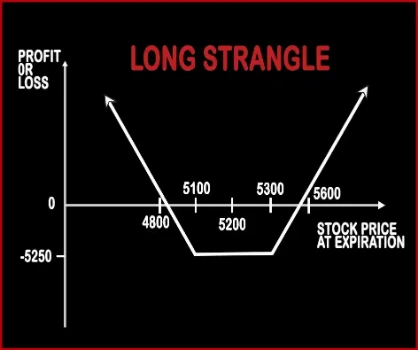

Long Strangle Option StrategyA Strangle is similar to Straddle. In Strangle, a trader will purchase one OTM Call Option and one OTM Put Option, of the same expiry date and the same underlying asset. This strategy will reduce the entry cost for trader and it is also cheaper than straddle. A trader will make profits, if the market moves sharply in either direction and gives extra-ordinary returns in the .. |

PROTECTIVE COLLAR Vs LONG STRANGLE - Details

| PROTECTIVE COLLAR | LONG STRANGLE | |

|---|---|---|

| Market View | Neutral | Neutral |

| Type (CE/PE) | CE (Call Option) + PE (Put Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 2 | 2 |

| Strategy Level | Beginners | Beginners |

| Reward Profile | Limited | Unlimited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Purchase Price of Underlying + Net Premium Paid | Lower Breakeven Point = Strike Price of Put - Net Premium, Upper Breakeven Point = Strike Price of Call + Net Premium |

PROTECTIVE COLLAR Vs LONG STRANGLE - When & How to use ?

| PROTECTIVE COLLAR | LONG STRANGLE | |

|---|---|---|

| Market View | Neutral | Neutral |

| When to use? | This Strategy is implemented when the investor requires downside protection for the short - to medium term but at lower cost. | This strategy is used in special scenarios where you foresee a lot of volatility in the market due to election results, budget, policy change, annual result announcements etc. |

| Action | • Short 1 Call Option, • Long 1 Put Option | Buy OTM Call Option, Buy OTM Put Option |

| Breakeven Point | Purchase Price of Underlying + Net Premium Paid | Lower Breakeven Point = Strike Price of Put - Net Premium, Upper Breakeven Point = Strike Price of Call + Net Premium |

PROTECTIVE COLLAR Vs LONG STRANGLE - Risk & Reward

| PROTECTIVE COLLAR | LONG STRANGLE | |

|---|---|---|

| Maximum Profit Scenario | • Call strike - stock purchase price - net premium paid + net credit received | Profit = Price of Underlying - Strike Price of Long Call - Net Premium Paid |

| Maximum Loss Scenario | • Stock purchase price - put strike - net premium paid - put strike + net credit received | Max Loss = Net Premium Paid |

| Risk | Limited | Limited |

| Reward | Limited | Unlimited |

PROTECTIVE COLLAR Vs LONG STRANGLE - Strategy Pros & Cons

| PROTECTIVE COLLAR | LONG STRANGLE | |

|---|---|---|

| Similar Strategies | Bull Put Spread, Bull Call Spread | Long Straddle, Short Strangle |

| Disadvantage | • Potential profit is lower or limited. | • Require significant price movement to book profit. • Traders can lose more money if the underlying asset stayed stagnant. |

| Advantages | The Risk is limited. | • Able to book profit, no matter if the underlying asset goes in either direction. • Limited loss to the debit paid. • If the underlying asset continues to move in one direction then you can book Unlimited profit . |