Compare Strategies

| BULL CALL SPREAD | RATIO PUT WRITE | |

|---|---|---|

|

|

|

| About Strategy |

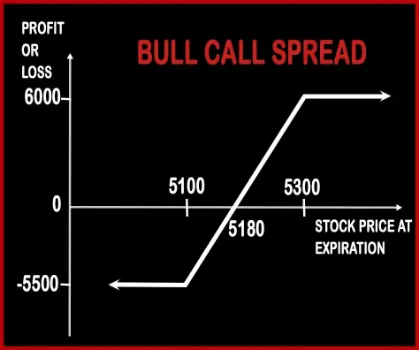

Bull Call Spread Option StrategyBull Call Spread option trading strategy is used by a trader who is bullish in nature and expects the underlying asset to give decent returns in the near future. This strategy includes buying of an ‘In The Money’ Call Option and selling of ‘Deep Out Of the Money’ Call Option of the same underlying asset and the same expiration date. |

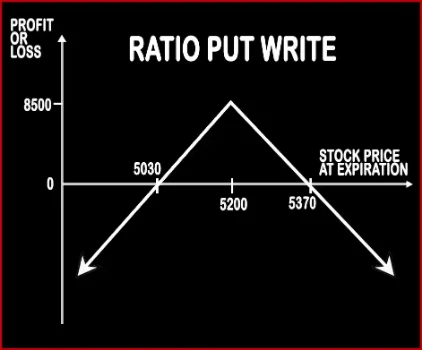

Ratio Put Write Option StrategyThis strategy is implemented by selling (short) the underlying asset in the cash/futures market. Simultaneously, sell ATM Puts double the number of long quantity. This strategy is used by a trader who in neutral on the market and bearish on the volatility in the near future. Here profits will be capped up to the premium amount and risk will be potentially unlimited. .. |

BULL CALL SPREAD Vs RATIO PUT WRITE - Details

| BULL CALL SPREAD | RATIO PUT WRITE | |

|---|---|---|

| Market View | Bullish | Neutral |

| Type (CE/PE) | CE (Call Option) | PE (Put Option) |

| Number Of Positions | 2 | 2 |

| Strategy Level | Beginners | Beginners |

| Reward Profile | Limited | Max Profit Achieved When Price of Underlying = Strike Price of Short Puts |

| Risk Profile | Limited | Loss Occurs When Price of Underlying < Strike Price of Short Put - Net Premium Received OR Price of Underlying > Strike Price of Short Put + Net Premium Received |

| Breakeven Point | Strike price of purchased call + net premium paid | Upper Breakeven Point = Strike Price of Short Puts + Points of Maximum Profit Lower Breakeven Point = Strike Price of Short Puts - Points of Maximum Profit |

BULL CALL SPREAD Vs RATIO PUT WRITE - When & How to use ?

| BULL CALL SPREAD | RATIO PUT WRITE | |

|---|---|---|

| Market View | Bullish | Neutral |

| When to use? | This strategy is used when an investor is Bullish in the market but expect the underlying to gain mildly in near future. | This strategy is implemented by selling (short) the underlying asset in the cash/futures market. This strategy is used by a trader who in neutral on the market and bearish on the volatility in the near future |

| Action | Buy ITM Call Option, Sell OTM Call Option | Sell 2 ATM Puts |

| Breakeven Point | Strike price of purchased call + net premium paid | Upper Breakeven Point = Strike Price of Short Puts + Points of Maximum Profit Lower Breakeven Point = Strike Price of Short Puts - Points of Maximum Profit |

BULL CALL SPREAD Vs RATIO PUT WRITE - Risk & Reward

| BULL CALL SPREAD | RATIO PUT WRITE | |

|---|---|---|

| Maximum Profit Scenario | (Strike Price of Call 1 - Strike Price of Call 2) - Net Premium Paid | Net Premium Received - Commissions Paid |

| Maximum Loss Scenario | Net Premium Paid | Price of Underlying - Sale Price of Underlying - Net Premium Received OR Strike Price of Short Put - Price of Underlying - Net Premium Received + Commissions Paid |

| Risk | Limited | Unlimited |

| Reward | Limited | Limited |

BULL CALL SPREAD Vs RATIO PUT WRITE - Strategy Pros & Cons

| BULL CALL SPREAD | RATIO PUT WRITE | |

|---|---|---|

| Similar Strategies | Collar | Short Strangle and Short Straddle |

| Disadvantage | • Limited profit potential to the higher strike call sold if the underlying stock price rises. • Maximum profit only if stock rises to the higher of 2 strike prices selected. | • Potential loss is higher than gain. • Limited profit. |

| Advantages | • Allows you to reduce risk and cost of your investment. • When placing the spread, exit strategy is pre-determined in advance. • Risk is limited to the net premium paid. |