Compare Strategies

| COVERED CALL | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

|

|

|

| About Strategy |

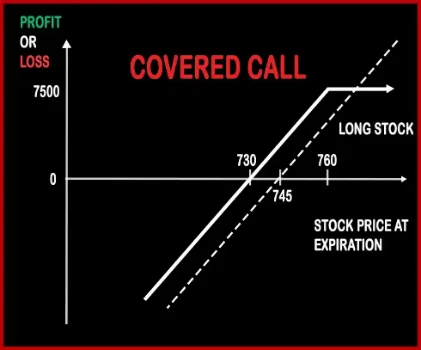

Covered Call Option StrategyMr. X owns Reliance Shares and expects the price to rise in the near future. Mr. X is entitled to receive dividends for the shares he hold in cash market. Covered Call Strategy involves selling of OTM Call Option of the same underlying asset. The OTM Call Option Strike Price will generally be the price, where Mr. X will look to get out o |

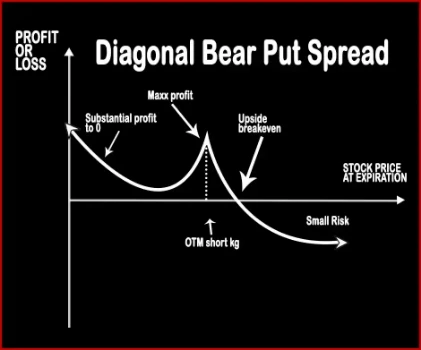

Diagonal Bear Put SpreadWhen the trader is neutral – bearish in the near-month and bearish in the mid-month, he will apply Diagonal Bear Put Spread. This strategy involves buying Mid-Month ITM Put Options and selling (short/write) equal number of Near-Month OTM Put Options, of the same underlying asset. This strategy bags limited rewards with limited risk. |

COVERED CALL Vs DIAGONAL BEAR PUT SPREAD - Details

| COVERED CALL | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Market View | Bullish | Bearish |

| Type (CE/PE) | CE (Call Option) | PE (Put Option) |

| Number Of Positions | 2 | 2 |

| Strategy Level | Advance | Beginners |

| Reward Profile | Limited | Limited |

| Risk Profile | Unlimited | Limited |

| Breakeven Point | Purchase Price of Underlying- Premium Received | This is a dynamic trade with many possible scenarios and future trades, it is impossible to calculate a breakeven. |

COVERED CALL Vs DIAGONAL BEAR PUT SPREAD - When & How to use ?

| COVERED CALL | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Market View | Bullish | Bearish |

| When to use? | An investor has a short term neutral view on the asset and for this reason holds the asset long and has a short position to generate income. | When the trader is neutral – bearish in the near-month and bearish in the mid-month, he will apply Diagonal Bear Put Spread. This strategy involves buying Mid-Month ITM Put Options and selling (short/write) equal number of Near-Month OTM Put Options, of the same underlying asset |

| Action | (Buy Underlying) (Sell OTM Call Option) | Sell 1 Near-Month OTM Put Option, Buy 1 Mid-Month ITM Put Option |

| Breakeven Point | Purchase Price of Underlying- Premium Received | This is a dynamic trade with many possible scenarios and future trades, it is impossible to calculate a breakeven. |

COVERED CALL Vs DIAGONAL BEAR PUT SPREAD - Risk & Reward

| COVERED CALL | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Maximum Profit Scenario | [Call Strike Price - Stock Price Paid] + Premium Received | 'Premiums received - Initial premium to execute + Strike price - Stock Price on final month |

| Maximum Loss Scenario | Purchase Price of Underlying - Price of Underlying) + Premium Received | When the stock trades up above the long-term put strike price. |

| Risk | Unlimited | Limited |

| Reward | Limited | Limited |

COVERED CALL Vs DIAGONAL BEAR PUT SPREAD - Strategy Pros & Cons

| COVERED CALL | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Similar Strategies | Bull Call Spread | Bear Put Spread and Bear Call Spread |

| Disadvantage | • Unlimited risk, limited reward. • Inability to earn interest on the proceed used to buy the underlying stock. | Higher commissions due to additional trades. , Changes maximum profit potential of call or put spreads. |

| Advantages | • Profit from option premium, rise in the underlying stock and dividends on the stock. • Allows you to generate income from your holding. • Profit when underlying stock price rise, move sideways or marginal fall. | The Risk is limited. |