Compare Strategies

| SHORT PUT | SHORT CALL LADDER | |

|---|---|---|

|

|

|

| About Strategy |

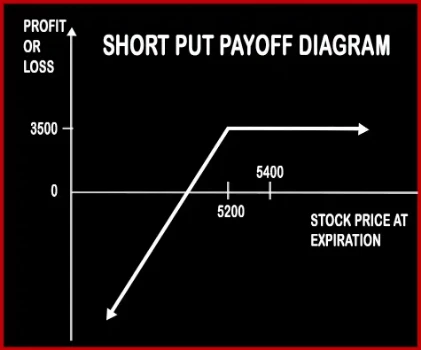

Short Put Option StrategyA trader will short put if he is bullish in nature and expects the underlying asset not to fall below a certain level. Risk: Losses will be potentially unlimited if the stock skyrockets above the strike price of put. |

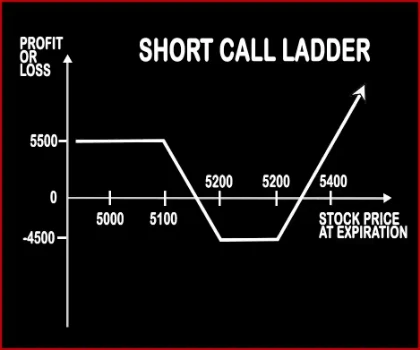

Short Call Ladder Option StrategyThis strategy is implemented when a trader is moderately bullish on the market, and volatility. It involves sale of an ITM Call Option, buying of an ATM Call Option & OTM Call Option. The risk associated with the strategy is limited. Risk:

|

SHORT PUT Vs SHORT CALL LADDER - Details

| SHORT PUT | SHORT CALL LADDER | |

|---|---|---|

| Market View | Bullish | Neutral |

| Type (CE/PE) | PE (Put Option) | CE (Call Option) |

| Number Of Positions | 1 | 3 |

| Strategy Level | Beginners | Advance |

| Reward Profile | Limited | Unlimited |

| Risk Profile | Unlimited | Limited |

| Breakeven Point | Strike Price - Premium | Upper Breakeven Point = Total Strike Prices of Long Calls - Strike Price of Short Call + Net Premium Received Lower Breakeven Point = Strike Price of Short Call - Net Premium Received |

SHORT PUT Vs SHORT CALL LADDER - When & How to use ?

| SHORT PUT | SHORT CALL LADDER | |

|---|---|---|

| Market View | Bullish | Neutral |

| When to use? | This strategy works well when you're Bullish that the price of the underlying will not fall beyond a certain level. | This strategy is implemented when a trader is moderately bullish on the market, and volatility |

| Action | Sell Put Option | Sell 1 ITM Call, Buy 1 ATM Call, Buy 1 OTM Call |

| Breakeven Point | Strike Price - Premium | Upper Breakeven Point = Total Strike Prices of Long Calls - Strike Price of Short Call + Net Premium Received Lower Breakeven Point = Strike Price of Short Call - Net Premium Received |

SHORT PUT Vs SHORT CALL LADDER - Risk & Reward

| SHORT PUT | SHORT CALL LADDER | |

|---|---|---|

| Maximum Profit Scenario | Premium received in your account when you sell the Put Option. | Profit Achieved When Price of Underlying > Total Strike Prices of Long Calls - Strike Price of Short Call + Net Premium Received |

| Maximum Loss Scenario | Unlimited (When the price of the underlying falls.) | Strike Price of Lower Strike Long Call - Strike Price of Short Call - Net Premium Received + Commissions Paid |

| Risk | Unlimited | Limited |

| Reward | Limited | Unlimited |

SHORT PUT Vs SHORT CALL LADDER - Strategy Pros & Cons

| SHORT PUT | SHORT CALL LADDER | |

|---|---|---|

| Similar Strategies | Bull Put Spread, Short Starddle | Short Put Ladder, Strip, Strap |

| Disadvantage | • Unlimited risk. • Huge losses if the price of the underlying stock falls steeply. | • Unlimited risk. • Margin required. |

| Advantages | • Benefit from time decay. • Less capital required than buying the stock outright. • Profit when underlying stock price rise, move sideways or drop by a relatively small account. | • Higher probability of profit. • Unlimited upside profit. • Limited maximum loss. |