Compare Strategies

| REVERSE IRON BUTTERFLY | RATIO PUT SPREAD | |

|---|---|---|

|

|

|

| About Strategy |

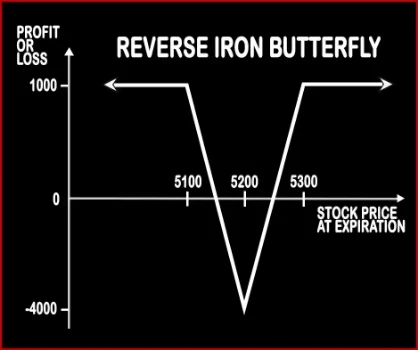

Reverse Iron Butterfly Option StrategyReverse Iron Butterfly as the name suggests is the opposite of Iron Butterfly. In Reverse Iron Butterfly, a trader is bullish on volatility and expects the market to make significant move in the near future in either directions. Here a trader will buy 1 ATM Call Option, sell 1 OTM Call Option, buy 1 ATM Put Option, sell 1 OTM Put Option. This strategy also bags lim |

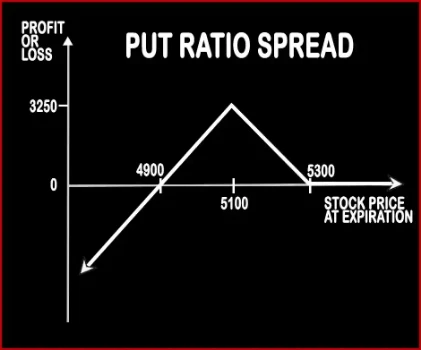

Ratio Put Spread Option StrategyThis strategy involves buying ITM Puts and simultaneously selling OTM Puts, double the number of ITM Puts. This strategy is used by a trader who is neutral on the market and bearish on the volatility in the near future. Here profits will be capped up to the premium amount and risk will be potentially unlimited. |

REVERSE IRON BUTTERFLY Vs RATIO PUT SPREAD - Details

| REVERSE IRON BUTTERFLY | RATIO PUT SPREAD | |

|---|---|---|

| Market View | Neutral | Neutral |

| Type (CE/PE) | CE (Call Option) + PE (Put Option) | PE (Put Option) |

| Number Of Positions | 4 | 3 |

| Strategy Level | Advance | Beginners |

| Reward Profile | Limited | Limited |

| Risk Profile | Limited | Unlimited |

| Breakeven Point | Upper Breakeven Point = Strike Price of Long Call + Net Premium Paid, Lower Breakeven Point = Strike Price of Long Put - Net Premium Paid | Upper Breakeven Point = Strike Price of Long Put +/- Net Premium Received or Paid, Lower Breakeven Point = Strike Price of Short Puts - (Points of Maximum Profit / Number of Uncovered Puts) |

REVERSE IRON BUTTERFLY Vs RATIO PUT SPREAD - When & How to use ?

| REVERSE IRON BUTTERFLY | RATIO PUT SPREAD | |

|---|---|---|

| Market View | Neutral | Neutral |

| When to use? | This strategy is used when a trader is bullish on volatility and expects the market to make significant move in the near future in either directions. | This strategy is used by a trader who is neutral on the market and bearish on the volatility in the near future. |

| Action | Sell 1 OTM Put, Buy 1 ATM Put, Buy 1 ATM Call, Sell 1 OTM Call | Buy 1 ITM Put, Sell 2 OTM Puts |

| Breakeven Point | Upper Breakeven Point = Strike Price of Long Call + Net Premium Paid, Lower Breakeven Point = Strike Price of Long Put - Net Premium Paid | Upper Breakeven Point = Strike Price of Long Put +/- Net Premium Received or Paid, Lower Breakeven Point = Strike Price of Short Puts - (Points of Maximum Profit / Number of Uncovered Puts) |

REVERSE IRON BUTTERFLY Vs RATIO PUT SPREAD - Risk & Reward

| REVERSE IRON BUTTERFLY | RATIO PUT SPREAD | |

|---|---|---|

| Maximum Profit Scenario | Strike Price of Short Call (or Long Put) - Strike Price of Long Call (or Short Put) - Net Premium Paid - Commissions Paid | Strike Price of Long Put - Strike Price of Short Put + Net Premium Received - Commissions Paid |

| Maximum Loss Scenario | Net Premium Paid + Commissions Paid | Strike Price of Short - Price of Underlying - Max Profit + Commissions Paid |

| Risk | Limited | Unlimited |

| Reward | Limited | Limited |

REVERSE IRON BUTTERFLY Vs RATIO PUT SPREAD - Strategy Pros & Cons

| REVERSE IRON BUTTERFLY | RATIO PUT SPREAD | |

|---|---|---|

| Similar Strategies | Short Put Butterfly, Short Condor | Short Straddle (Sell Straddle), Short Strangle (Sell Strangle) |

| Disadvantage | • Potential loss is higher than gain, complex strategy. • Not suitable for beginners. | • Unlimited potential risk. • Limited profit. |

| Advantages | • Able to profit whether stocks move in either direction up or down. • This strategy can be used by option traders who cannot use credit spreads. • Predictable maximum loss and profits, volatile strategy. | • Directional strategy so that there is either no upside or downside risk. • Able to profit even if trader is neutral on the market. • Higher probability of profit. |