Compare Strategies

| SHORT CALL CONDOR SPREAD | PROTECTIVE COLLAR | |

|---|---|---|

|

|

|

| About Strategy |

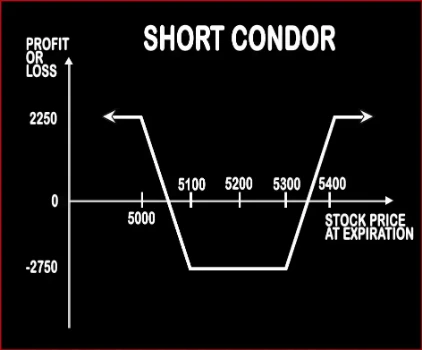

Short Call Condor Spread Option StrategyShort Call Condor Spread is the opposite of Long Call Condor Spread i.e. sell 1 Deep ITM Call Option, buy 1 ITM Call Option, buy 1 OTM Call Option, sell 1 Deep OTM Call Option. Similar to Long Call Condor, the risk and rewards associated with this strategy are limited. Credit is received at the time of entering into this strategy. |

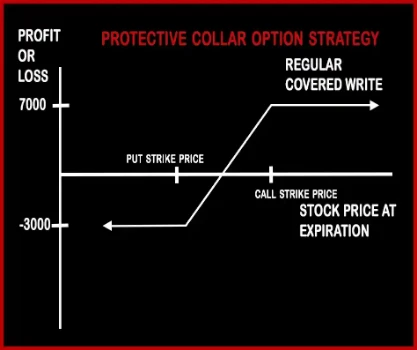

Protective Collar Strategy This Strategy is implemented when the investor requires downside protection for the short - to medium term but at lower cost. Buying protective puts can be an expensive proposition and writing OTM calls can defray the cost of the puts quite substantially. Protective Collar is considered as bearish to neutral strategy. In this strategy risk and reward is both are limited. This .. |

SHORT CALL CONDOR SPREAD Vs PROTECTIVE COLLAR - Details

| SHORT CALL CONDOR SPREAD | PROTECTIVE COLLAR | |

|---|---|---|

| Market View | Volatile | Neutral |

| Type (CE/PE) | CE (Call Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 4 | 2 |

| Strategy Level | Advance | Beginners |

| Reward Profile | Limited | Limited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Lower Breakeven = Lower Strike Price + Net Premium, Upper breakeven = Higher Strike Price - Net Premium | Purchase Price of Underlying + Net Premium Paid |

SHORT CALL CONDOR SPREAD Vs PROTECTIVE COLLAR - When & How to use ?

| SHORT CALL CONDOR SPREAD | PROTECTIVE COLLAR | |

|---|---|---|

| Market View | Volatile | Neutral |

| When to use? | This strategy is used when an investor expect the price of the underlying stock to be very volatile. | This Strategy is implemented when the investor requires downside protection for the short - to medium term but at lower cost. |

| Action | Buy ITM Call Option + Buy OTM Call Option + Sell Deep OTM Call Option + Sell Deep ITM Call Option | • Short 1 Call Option, • Long 1 Put Option |

| Breakeven Point | Lower Breakeven = Lower Strike Price + Net Premium, Upper breakeven = Higher Strike Price - Net Premium | Purchase Price of Underlying + Net Premium Paid |

SHORT CALL CONDOR SPREAD Vs PROTECTIVE COLLAR - Risk & Reward

| SHORT CALL CONDOR SPREAD | PROTECTIVE COLLAR | |

|---|---|---|

| Maximum Profit Scenario | Strike Price of Lower Strike Short Call - Strike Price of Lower Strike Long Call - Net Premium Paid | • Call strike - stock purchase price - net premium paid + net credit received |

| Maximum Loss Scenario | Strike Price of Lower Strike Long Call - Strike Price of Lower Strike Short Call - Net Premium Received + Commissions Paid | • Stock purchase price - put strike - net premium paid - put strike + net credit received |

| Risk | Limited | Limited |

| Reward | Limited | Limited |

SHORT CALL CONDOR SPREAD Vs PROTECTIVE COLLAR - Strategy Pros & Cons

| SHORT CALL CONDOR SPREAD | PROTECTIVE COLLAR | |

|---|---|---|

| Similar Strategies | Short Strangle | Bull Put Spread, Bull Call Spread |

| Disadvantage | • Amount of profit is low in comparison with other strategies. • As this strategy has 4 legs so the brokerage cost is higher that will affect your profit. | • Potential profit is lower or limited. |

| Advantages | • This strategy allows you to profit from highly volatile underlying assets moving in any direction. • Earn profit with little or no investment. • Wider profit zone. | The Risk is limited. |