Compare Strategies

| SHORT STRADDLE | CALL BACKSPREAD | |

|---|---|---|

|

|

|

| About Strategy |

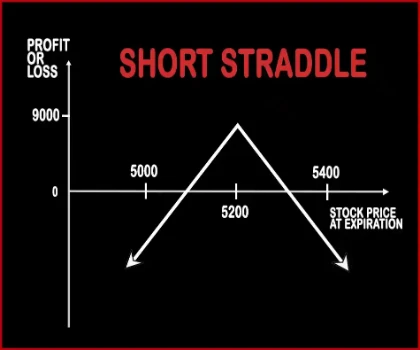

Short Straddle Option strategyThis strategy is just the opposite of Long Straddle. A trader should adopt this strategy when he expects less volatility in the near future. Here, a trader will sell one Call Option & one Put Option of the same strike price, same expiry date and of the same underlying asset. If the stock/index hovers around the same levels then both the options will expire worthless an |

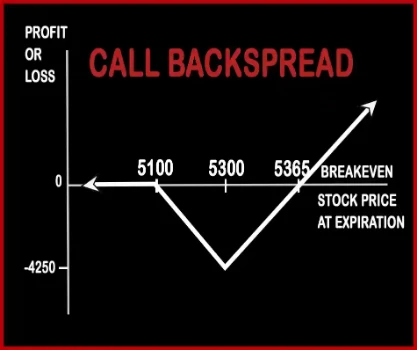

Call Backspread Option Trading This strategy is adopted by traders who are bullish in nature. He expects market and volatility to rise in the near future. A trader need not be direction specific here (i.e. an upward or downward trend, but a small bias towards an uptrend should always be present, as the gains will be much higher once the market moves up r .. |

SHORT STRADDLE Vs CALL BACKSPREAD - Details

| SHORT STRADDLE | CALL BACKSPREAD | |

|---|---|---|

| Market View | Neutral | Bullish |

| Type (CE/PE) | CE (Call Option) + PE (Put Option) | CE (Call Option) |

| Number Of Positions | 2 | 3 |

| Strategy Level | Advance | Advance |

| Reward Profile | Limited | Unlimited |

| Risk Profile | Unlimited | Limited |

| Breakeven Point | Lower Breakeven = Strike Price of Put - Net Premium, Upper breakeven = Strike Price of Call+ Net Premium | Lower breakeven = strike price of the short call, Upper breakeven = strike price of long calls + point of maximum loss |

SHORT STRADDLE Vs CALL BACKSPREAD - When & How to use ?

| SHORT STRADDLE | CALL BACKSPREAD | |

|---|---|---|

| Market View | Neutral | Bullish |

| When to use? | This strategy is work well when an investor expect a flat market in the coming days with very less movement in the prices of underlying asset. | This strategy is used when the investor expects the price of the stock to rise in the future. |

| Action | Sell Call Option, Sell Put Option | Sell 1 ITM Call, BUY 2 OTM Call |

| Breakeven Point | Lower Breakeven = Strike Price of Put - Net Premium, Upper breakeven = Strike Price of Call+ Net Premium | Lower breakeven = strike price of the short call, Upper breakeven = strike price of long calls + point of maximum loss |

SHORT STRADDLE Vs CALL BACKSPREAD - Risk & Reward

| SHORT STRADDLE | CALL BACKSPREAD | |

|---|---|---|

| Maximum Profit Scenario | Max Profit = Net Premium Received - Commissions Paid | Unlimited profit potential if the stock goes in upward direction. |

| Maximum Loss Scenario | Maximum Loss = Long Call Strike Price - Short Call Strike Price - Net Premium Received | Strike Price of long call - Strike Price of short call - Net premium received |

| Risk | Unlimited | Limited |

| Reward | Limited | Unlimited |

SHORT STRADDLE Vs CALL BACKSPREAD - Strategy Pros & Cons

| SHORT STRADDLE | CALL BACKSPREAD | |

|---|---|---|

| Similar Strategies | Short Strangle | - |

| Disadvantage | • Unlimited risk. • If the price of the underlying asset moves in either direction then huge losses can occur. | |

| Advantages | • A trader can earn profit even when there is no volatility in the market . • Allows you to benefit from double time decay. • Trader can collect premium from puts and calls option . | • Unlimited profit potential. |