Compare Strategies

| PROTECTIVE CALL | SHORT PUT | |

|---|---|---|

|

|

|

| About Strategy |

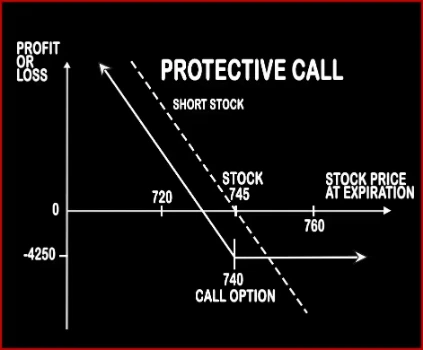

Protective Call Option StrategyThis strategy is simply the reversal of the Synthetic Call Strategy. This strategy is implemented when a trader is bearish on the market and expects to go down. Trader will short underlying stock in the cash market and buy either an ATM Call Option or OTM Call Option. The Call Option is bought to protect / hedge the upside risk on the short position. The |

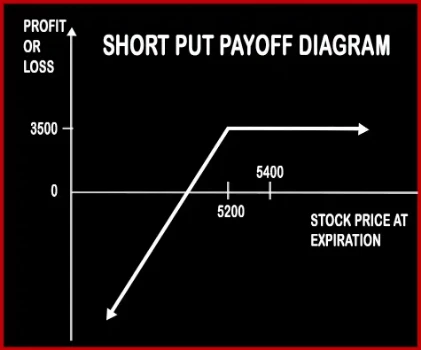

Short Put Option StrategyA trader will short put if he is bullish in nature and expects the underlying asset not to fall below a certain level. Risk: Losses will be potentially unlimited if the stock skyrockets above the strike price of put. |

PROTECTIVE CALL Vs SHORT PUT - Details

| PROTECTIVE CALL | SHORT PUT | |

|---|---|---|

| Market View | Bearish | Bullish |

| Type (CE/PE) | CE (Call Option) | PE (Put Option) |

| Number Of Positions | 1 | 1 |

| Strategy Level | Beginners | Beginners |

| Reward Profile | Unlimited | Limited |

| Risk Profile | Limited | Unlimited |

| Breakeven Point | Sale Price of Underlying + Premium Paid | Strike Price - Premium |

PROTECTIVE CALL Vs SHORT PUT - When & How to use ?

| PROTECTIVE CALL | SHORT PUT | |

|---|---|---|

| Market View | Bearish | Bullish |

| When to use? | This strategy is implemented when a trader is bearish on the market and expects to go down. | This strategy works well when you're Bullish that the price of the underlying will not fall beyond a certain level. |

| Action | Buy 1 ATM Call | Sell Put Option |

| Breakeven Point | Sale Price of Underlying + Premium Paid | Strike Price - Premium |

PROTECTIVE CALL Vs SHORT PUT - Risk & Reward

| PROTECTIVE CALL | SHORT PUT | |

|---|---|---|

| Maximum Profit Scenario | Sale Price of Underlying - Price of Underlying - Premium Paid | Premium received in your account when you sell the Put Option. |

| Maximum Loss Scenario | Premium Paid + Call Strike Price - Sale Price of Underlying + Commissions Paid | Unlimited (When the price of the underlying falls.) |

| Risk | Limited | Unlimited |

| Reward | Unlimited | Limited |

PROTECTIVE CALL Vs SHORT PUT - Strategy Pros & Cons

| PROTECTIVE CALL | SHORT PUT | |

|---|---|---|

| Similar Strategies | Put Backspread, Long Put | Bull Put Spread, Short Starddle |

| Disadvantage | • Profitable when market moves as expected. • Not good for beginners. | • Unlimited risk. • Huge losses if the price of the underlying stock falls steeply. |

| Advantages | • Limited risk if the market moves in opposite direction as expected. • Allows you to keep open a profitable position to make further profits. • Unlimited profit potential. | • Benefit from time decay. • Less capital required than buying the stock outright. • Profit when underlying stock price rise, move sideways or drop by a relatively small account. |