Compare Strategies

| LONG PUT LADDER | STOCK REPAIR | |

|---|---|---|

|

|

|

| About Strategy |

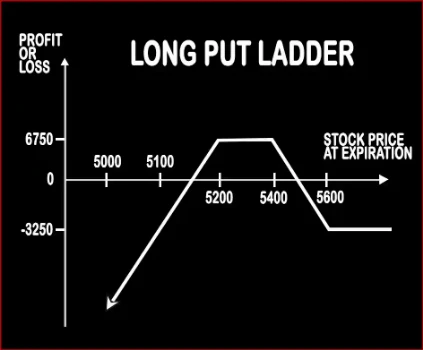

Long Put Ladder Option StrategyLong Put Ladder can be implemented when a trader is slightly bearish on the market and volatility. It involves buying of an ITM Put Option and sale of 1 ATM & 1 OTM Put Options. However, the risk associated with this strategy is unlimited and reward is limited. Risk:< |

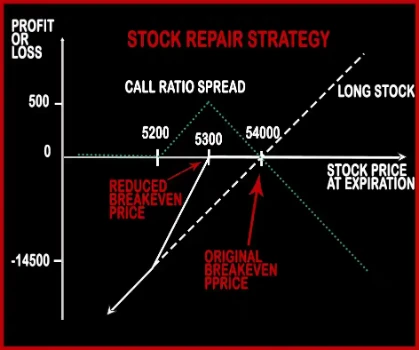

Stock Repair Option StrategyStock Repair Strategy is used to cover up for losses made on long stock position. After the long position suffered losses on stock price fall, a trader will implement this strategy in order to bring down the breakeven price and capping his further losses thereby increasing his probability of loss recovery. Suppose Mr. X has .. |

LONG PUT LADDER Vs STOCK REPAIR - Details

| LONG PUT LADDER | STOCK REPAIR | |

|---|---|---|

| Market View | Neutral | Bullish |

| Type (CE/PE) | PE (Put Option) | CE (Call Option) |

| Number Of Positions | 3 | 3 |

| Strategy Level | Advance | Beginners |

| Reward Profile | Limited | Unlimited |

| Risk Profile | Unlimited | Limited |

| Breakeven Point | Upper Breakeven Point = Strike Price of Long Put - Net Premium Paid, Lower Breakeven Point = Total Strike Prices of Short Puts - Strike Price of Long Put + Net Premium Paid |

LONG PUT LADDER Vs STOCK REPAIR - When & How to use ?

| LONG PUT LADDER | STOCK REPAIR | |

|---|---|---|

| Market View | Neutral | Bullish |

| When to use? | This Strategy can be implemented when a trader is slightly bearish on the market and volatility. | Stock Repair Strategy is used to cover up for losses made on long stock position. After the long position suffered losses on stock price fall, a trader will implement this strategy in order to bring down the breakeven price and capping his further losses thereby increasing his probability of loss recovery. |

| Action | Buy 1 ITM Put, Sell 1 ATM Put, Sell 1 OTM Put | Buy 1 ATM Call, Sell 2 OTM Calls |

| Breakeven Point | Upper Breakeven Point = Strike Price of Long Put - Net Premium Paid, Lower Breakeven Point = Total Strike Prices of Short Puts - Strike Price of Long Put + Net Premium Paid |

LONG PUT LADDER Vs STOCK REPAIR - Risk & Reward

| LONG PUT LADDER | STOCK REPAIR | |

|---|---|---|

| Maximum Profit Scenario | Strike Price of Long Put - Strike Price of Higher Strike Short Put - Net Premium Paid - Commissions Paid | |

| Maximum Loss Scenario | When Price of Underlying < Total Strike Prices of Short Puts - Strike Price of Long Put + Net Premium Paid | |

| Risk | Unlimited | Limited |

| Reward | Limited | Unlimited |

LONG PUT LADDER Vs STOCK REPAIR - Strategy Pros & Cons

| LONG PUT LADDER | STOCK REPAIR | |

|---|---|---|

| Similar Strategies | Short Strangle (Sell Strangle), Short Straddle (Sell Straddle) | |

| Disadvantage | • Unlimited risk. • Margin required. | • Management required with all the positions. • Additional loss due to continuous decline in shares as downside risk remains unchanged. |

| Advantages | • Reduces capital outlay of bear put spread. • Wider maximum profit zone. • When there is decrease in implied volatility, this strategy can give profit. | • This strategy creates an opportunity to recover losses by lowering our breakeven. • No margin required. • No additional downside risk and costs nothing to put on. |