Compare Strategies

| RATIO PUT WRITE | REVERSE IRON BUTTERFLY | |

|---|---|---|

|

|

|

| About Strategy |

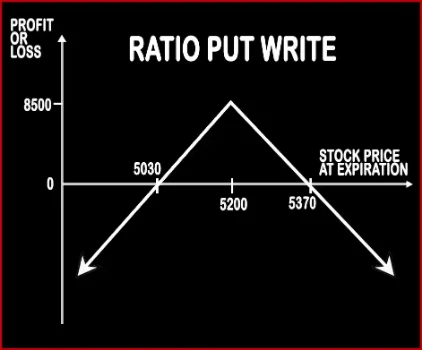

Ratio Put Write Option StrategyThis strategy is implemented by selling (short) the underlying asset in the cash/futures market. Simultaneously, sell ATM Puts double the number of long quantity. This strategy is used by a trader who in neutral on the market and bearish on the volatility in the near future. Here profits will be capped up to the premium amount and risk will be potentially unlimited. |

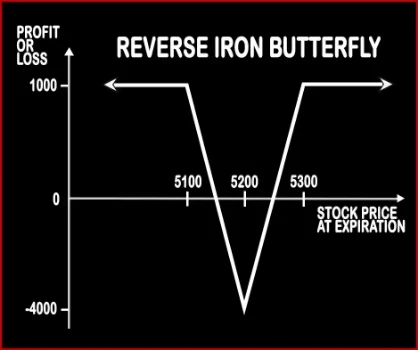

Reverse Iron Butterfly Option StrategyReverse Iron Butterfly as the name suggests is the opposite of Iron Butterfly. In Reverse Iron Butterfly, a trader is bullish on volatility and expects the market to make significant move in the near future in either directions. Here a trader will buy 1 ATM Call Option, sell 1 OTM Call Option, buy 1 ATM Put Option, sell 1 OTM Put Option. This strategy also bags lim .. |

RATIO PUT WRITE Vs REVERSE IRON BUTTERFLY - Details

| RATIO PUT WRITE | REVERSE IRON BUTTERFLY | |

|---|---|---|

| Market View | Neutral | Neutral |

| Type (CE/PE) | PE (Put Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 2 | 4 |

| Strategy Level | Beginners | Advance |

| Reward Profile | Max Profit Achieved When Price of Underlying = Strike Price of Short Puts | Limited |

| Risk Profile | Loss Occurs When Price of Underlying < Strike Price of Short Put - Net Premium Received OR Price of Underlying > Strike Price of Short Put + Net Premium Received | Limited |

| Breakeven Point | Upper Breakeven Point = Strike Price of Short Puts + Points of Maximum Profit Lower Breakeven Point = Strike Price of Short Puts - Points of Maximum Profit | Upper Breakeven Point = Strike Price of Long Call + Net Premium Paid, Lower Breakeven Point = Strike Price of Long Put - Net Premium Paid |

RATIO PUT WRITE Vs REVERSE IRON BUTTERFLY - When & How to use ?

| RATIO PUT WRITE | REVERSE IRON BUTTERFLY | |

|---|---|---|

| Market View | Neutral | Neutral |

| When to use? | This strategy is implemented by selling (short) the underlying asset in the cash/futures market. This strategy is used by a trader who in neutral on the market and bearish on the volatility in the near future | This strategy is used when a trader is bullish on volatility and expects the market to make significant move in the near future in either directions. |

| Action | Sell 2 ATM Puts | Sell 1 OTM Put, Buy 1 ATM Put, Buy 1 ATM Call, Sell 1 OTM Call |

| Breakeven Point | Upper Breakeven Point = Strike Price of Short Puts + Points of Maximum Profit Lower Breakeven Point = Strike Price of Short Puts - Points of Maximum Profit | Upper Breakeven Point = Strike Price of Long Call + Net Premium Paid, Lower Breakeven Point = Strike Price of Long Put - Net Premium Paid |

RATIO PUT WRITE Vs REVERSE IRON BUTTERFLY - Risk & Reward

| RATIO PUT WRITE | REVERSE IRON BUTTERFLY | |

|---|---|---|

| Maximum Profit Scenario | Net Premium Received - Commissions Paid | Strike Price of Short Call (or Long Put) - Strike Price of Long Call (or Short Put) - Net Premium Paid - Commissions Paid |

| Maximum Loss Scenario | Price of Underlying - Sale Price of Underlying - Net Premium Received OR Strike Price of Short Put - Price of Underlying - Net Premium Received + Commissions Paid | Net Premium Paid + Commissions Paid |

| Risk | Unlimited | Limited |

| Reward | Limited | Limited |

RATIO PUT WRITE Vs REVERSE IRON BUTTERFLY - Strategy Pros & Cons

| RATIO PUT WRITE | REVERSE IRON BUTTERFLY | |

|---|---|---|

| Similar Strategies | Short Strangle and Short Straddle | Short Put Butterfly, Short Condor |

| Disadvantage | • Potential loss is higher than gain. • Limited profit. | • Potential loss is higher than gain, complex strategy. • Not suitable for beginners. |

| Advantages | • Able to profit whether stocks move in either direction up or down. • This strategy can be used by option traders who cannot use credit spreads. • Predictable maximum loss and profits, volatile strategy. |