Compare Strategies

| STRIP | RISK REVERSAL | |

|---|---|---|

|

|

|

| About Strategy |

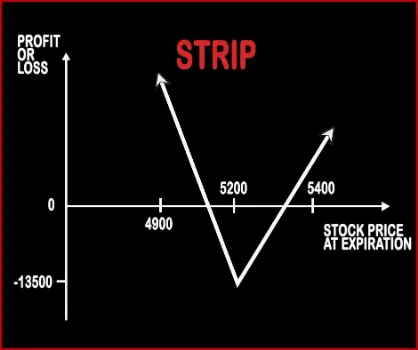

Strip Option StrategyStrip Strategy is the opposite of Strap Strategy. When a trader is bearish on the market and bullish on volatility then he will implement this strategy by buying two ATM Put Options & one ATM Call Option, of the same strike price, expiry date & underlying asset. If the prices move downwards then this strategy will make more profits compared to short straddle because of the |

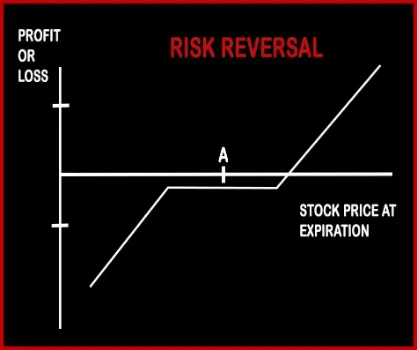

Risk Reversal Option StrategyThis strategy protects an investor from unfavourable price movements in the position but limits the profits can be made on that position. A risk reversal is a hedging strategy that protects a long or short position by using put and call options. In this one option is buying and other is written. In this strategy the trader has to pay a premium, while the written option prod .. |

STRIP Vs RISK REVERSAL - Details

| STRIP | RISK REVERSAL | |

|---|---|---|

| Market View | Neutral | Bullish |

| Type (CE/PE) | CE (Call Option) + PE (Put Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 3 | 2 |

| Strategy Level | Beginners | Advance |

| Reward Profile | Unlimited | Unlimited |

| Risk Profile | Limited | Unlimited |

| Breakeven Point | Upper Breakeven Point = Strike Price of Calls/Puts + Net Premium Paid, Lower Breakeven Point = Strike Price of Calls/Puts - (Net Premium Paid/2) | Premium received - Put Strike Price |

STRIP Vs RISK REVERSAL - When & How to use ?

| STRIP | RISK REVERSAL | |

|---|---|---|

| Market View | Neutral | Bullish |

| When to use? | When a trader is bearish on the market and bullish on volatility then he will implement this strategy. | This strategy can be used for hedging. When an investor want to protect long or short position by using a call and put option. |

| Action | Buy 1 ATM Call, Buy 2 ATM Puts | This strategy work when an investor want to hedge their position by buying a put option and selling a call option. |

| Breakeven Point | Upper Breakeven Point = Strike Price of Calls/Puts + Net Premium Paid, Lower Breakeven Point = Strike Price of Calls/Puts - (Net Premium Paid/2) | Premium received - Put Strike Price |

STRIP Vs RISK REVERSAL - Risk & Reward

| STRIP | RISK REVERSAL | |

|---|---|---|

| Maximum Profit Scenario | Price of Underlying - Strike Price of Calls - Net Premium Paid OR 2 x (Strike Price of Puts - Price of Underlying) - Net Premium Paid | You have unlimited profit potential to the upside. |

| Maximum Loss Scenario | Net Premium Paid + Commissions Paid | You have nearly unlimited downside risk as well because you are short the put |

| Risk | Limited | Unlimited |

| Reward | Unlimited | Unlimited |

STRIP Vs RISK REVERSAL - Strategy Pros & Cons

| STRIP | RISK REVERSAL | |

|---|---|---|

| Similar Strategies | Strap, Short Put Ladder | - |

| Disadvantage | Expensive., The share price must change significantly to generate profit., High Bid/Offer spread can have a negative influence on the position. | Unlimited Risk. |

| Advantages | Profit is generated when the share price changes in any direction., Limited loss., The profit is potentially unlimited when share prices are moving. | Unlimited profit. |