Compare Strategies

| PROTECTIVE COLLAR | PROTECTIVE CALL | |

|---|---|---|

|

|

|

| About Strategy |

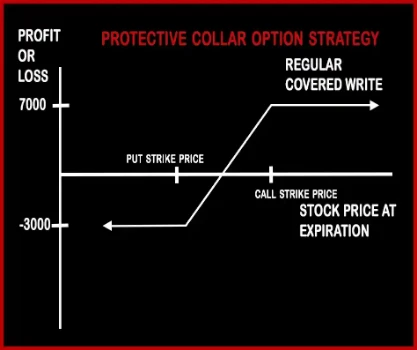

Protective Collar Strategy This Strategy is implemented when the investor requires downside protection for the short - to medium term but at lower cost. Buying protective puts can be an expensive proposition and writing OTM calls can defray the cost of the puts quite substantially. Protective Collar is considered as bearish to neutral strategy. In this strategy risk and reward is both are limited. This |

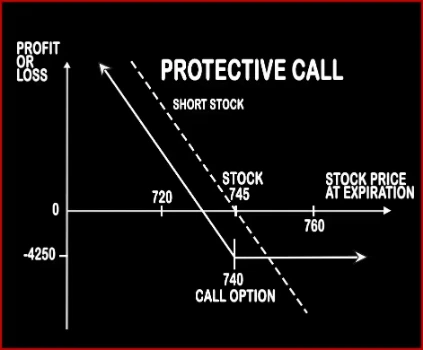

Protective Call Option StrategyThis strategy is simply the reversal of the Synthetic Call Strategy. This strategy is implemented when a trader is bearish on the market and expects to go down. Trader will short underlying stock in the cash market and buy either an ATM Call Option or OTM Call Option. The Call Option is bought to protect / hedge the upside risk on the short position. The .. |

PROTECTIVE COLLAR Vs PROTECTIVE CALL - Details

| PROTECTIVE COLLAR | PROTECTIVE CALL | |

|---|---|---|

| Market View | Neutral | Bearish |

| Type (CE/PE) | CE (Call Option) + PE (Put Option) | CE (Call Option) |

| Number Of Positions | 2 | 1 |

| Strategy Level | Beginners | Beginners |

| Reward Profile | Limited | Unlimited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Purchase Price of Underlying + Net Premium Paid | Sale Price of Underlying + Premium Paid |

PROTECTIVE COLLAR Vs PROTECTIVE CALL - When & How to use ?

| PROTECTIVE COLLAR | PROTECTIVE CALL | |

|---|---|---|

| Market View | Neutral | Bearish |

| When to use? | This Strategy is implemented when the investor requires downside protection for the short - to medium term but at lower cost. | This strategy is implemented when a trader is bearish on the market and expects to go down. |

| Action | • Short 1 Call Option, • Long 1 Put Option | Buy 1 ATM Call |

| Breakeven Point | Purchase Price of Underlying + Net Premium Paid | Sale Price of Underlying + Premium Paid |

PROTECTIVE COLLAR Vs PROTECTIVE CALL - Risk & Reward

| PROTECTIVE COLLAR | PROTECTIVE CALL | |

|---|---|---|

| Maximum Profit Scenario | • Call strike - stock purchase price - net premium paid + net credit received | Sale Price of Underlying - Price of Underlying - Premium Paid |

| Maximum Loss Scenario | • Stock purchase price - put strike - net premium paid - put strike + net credit received | Premium Paid + Call Strike Price - Sale Price of Underlying + Commissions Paid |

| Risk | Limited | Limited |

| Reward | Limited | Unlimited |

PROTECTIVE COLLAR Vs PROTECTIVE CALL - Strategy Pros & Cons

| PROTECTIVE COLLAR | PROTECTIVE CALL | |

|---|---|---|

| Similar Strategies | Bull Put Spread, Bull Call Spread | Put Backspread, Long Put |

| Disadvantage | • Potential profit is lower or limited. | • Profitable when market moves as expected. • Not good for beginners. |

| Advantages | The Risk is limited. | • Limited risk if the market moves in opposite direction as expected. • Allows you to keep open a profitable position to make further profits. • Unlimited profit potential. |