Compare Strategies

| CHRISTMAS TREE SPREAD WITH PUT OPTION | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

|

|

|

| About Strategy |

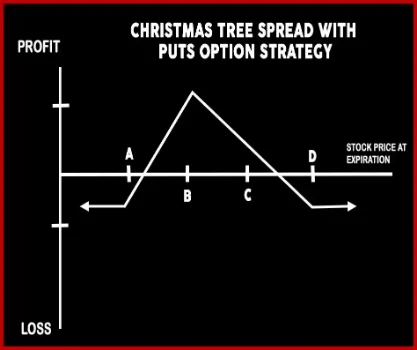

Christmas Tree Spread with Puts Option StrategyThis Strategy is an advance option strategy that consists of three legs and six total options. In this strategy buying one put at strike price D, skipping strike price C, writes three calls at strike price B, and buying two calls at strike price A for same expiration dates for neutral to bearish forecast. An investor used this strategy to potential returns |

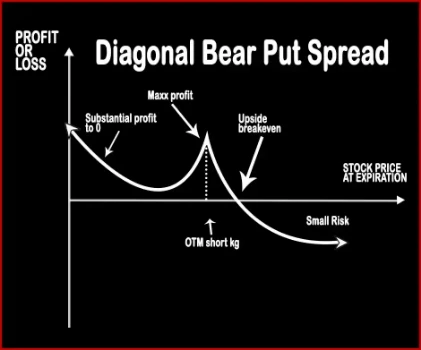

Diagonal Bear Put SpreadWhen the trader is neutral – bearish in the near-month and bearish in the mid-month, he will apply Diagonal Bear Put Spread. This strategy involves buying Mid-Month ITM Put Options and selling (short/write) equal number of Near-Month OTM Put Options, of the same underlying asset. This strategy bags limited rewards with limited risk. |

CHRISTMAS TREE SPREAD WITH PUT OPTION Vs DIAGONAL BEAR PUT SPREAD - Details

| CHRISTMAS TREE SPREAD WITH PUT OPTION | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Market View | Bearish | Bearish |

| Type (CE/PE) | CE (Call Option) | PE (Put Option) |

| Number Of Positions | 6 | 2 |

| Strategy Level | Advance | Beginners |

| Reward Profile | Limited | Limited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Lowest strike prices + the half premium – premium paid | This is a dynamic trade with many possible scenarios and future trades, it is impossible to calculate a breakeven. |

CHRISTMAS TREE SPREAD WITH PUT OPTION Vs DIAGONAL BEAR PUT SPREAD - When & How to use ?

| CHRISTMAS TREE SPREAD WITH PUT OPTION | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Market View | Bearish | Bearish |

| When to use? | This Strategy is used when an investor wants potential returns. | When the trader is neutral – bearish in the near-month and bearish in the mid-month, he will apply Diagonal Bear Put Spread. This strategy involves buying Mid-Month ITM Put Options and selling (short/write) equal number of Near-Month OTM Put Options, of the same underlying asset |

| Action | Buying one ATM, Selling 3 Puts, Buying one more OTM Put | Sell 1 Near-Month OTM Put Option, Buy 1 Mid-Month ITM Put Option |

| Breakeven Point | Lowest strike prices + the half premium – premium paid | This is a dynamic trade with many possible scenarios and future trades, it is impossible to calculate a breakeven. |

CHRISTMAS TREE SPREAD WITH PUT OPTION Vs DIAGONAL BEAR PUT SPREAD - Risk & Reward

| CHRISTMAS TREE SPREAD WITH PUT OPTION | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Maximum Profit Scenario | Equal middle strike price – higher strike price – the premium | 'Premiums received - Initial premium to execute + Strike price - Stock Price on final month |

| Maximum Loss Scenario | Net Debit paid for the strategy. | When the stock trades up above the long-term put strike price. |

| Risk | Limited | Limited |

| Reward | Limited | Limited |

CHRISTMAS TREE SPREAD WITH PUT OPTION Vs DIAGONAL BEAR PUT SPREAD - Strategy Pros & Cons

| CHRISTMAS TREE SPREAD WITH PUT OPTION | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Similar Strategies | Butterfly spreads | Bear Put Spread and Bear Call Spread |

| Disadvantage | • Potential profit is lower or limited. | Higher commissions due to additional trades. , Changes maximum profit potential of call or put spreads. |

| Advantages | • The potential of loss is limited. | The Risk is limited. |