Compare Strategies

| CALL BACKSPREAD | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

|

|

|

| About Strategy |

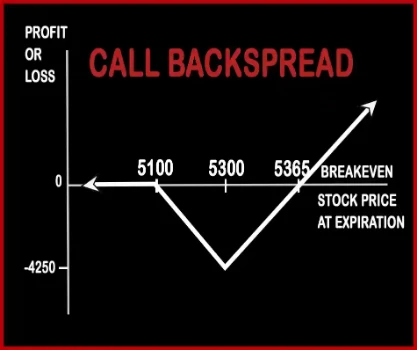

Call Backspread Option Trading This strategy is adopted by traders who are bullish in nature. He expects market and volatility to rise in the near future. A trader need not be direction specific here (i.e. an upward or downward trend, but a small bias towards an uptrend should always be present, as the gains will be much higher once the market moves up r |

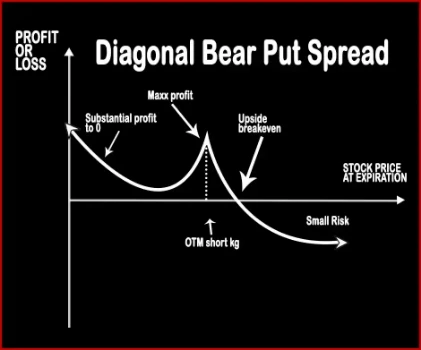

Diagonal Bear Put SpreadWhen the trader is neutral – bearish in the near-month and bearish in the mid-month, he will apply Diagonal Bear Put Spread. This strategy involves buying Mid-Month ITM Put Options and selling (short/write) equal number of Near-Month OTM Put Options, of the same underlying asset. This strategy bags limited rewards with limited risk. |

CALL BACKSPREAD Vs DIAGONAL BEAR PUT SPREAD - Details

| CALL BACKSPREAD | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Market View | Bullish | Bearish |

| Type (CE/PE) | CE (Call Option) | PE (Put Option) |

| Number Of Positions | 3 | 2 |

| Strategy Level | Advance | Beginners |

| Reward Profile | Unlimited | Limited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Lower breakeven = strike price of the short call, Upper breakeven = strike price of long calls + point of maximum loss | This is a dynamic trade with many possible scenarios and future trades, it is impossible to calculate a breakeven. |

CALL BACKSPREAD Vs DIAGONAL BEAR PUT SPREAD - When & How to use ?

| CALL BACKSPREAD | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Market View | Bullish | Bearish |

| When to use? | This strategy is used when the investor expects the price of the stock to rise in the future. | When the trader is neutral – bearish in the near-month and bearish in the mid-month, he will apply Diagonal Bear Put Spread. This strategy involves buying Mid-Month ITM Put Options and selling (short/write) equal number of Near-Month OTM Put Options, of the same underlying asset |

| Action | Sell 1 ITM Call, BUY 2 OTM Call | Sell 1 Near-Month OTM Put Option, Buy 1 Mid-Month ITM Put Option |

| Breakeven Point | Lower breakeven = strike price of the short call, Upper breakeven = strike price of long calls + point of maximum loss | This is a dynamic trade with many possible scenarios and future trades, it is impossible to calculate a breakeven. |

CALL BACKSPREAD Vs DIAGONAL BEAR PUT SPREAD - Risk & Reward

| CALL BACKSPREAD | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Maximum Profit Scenario | Unlimited profit potential if the stock goes in upward direction. | 'Premiums received - Initial premium to execute + Strike price - Stock Price on final month |

| Maximum Loss Scenario | Strike Price of long call - Strike Price of short call - Net premium received | When the stock trades up above the long-term put strike price. |

| Risk | Limited | Limited |

| Reward | Unlimited | Limited |

CALL BACKSPREAD Vs DIAGONAL BEAR PUT SPREAD - Strategy Pros & Cons

| CALL BACKSPREAD | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Similar Strategies | - | Bear Put Spread and Bear Call Spread |

| Disadvantage | Higher commissions due to additional trades. , Changes maximum profit potential of call or put spreads. | |

| Advantages | • Unlimited profit potential. | The Risk is limited. |