Compare Strategies

| SHORT CALL | SHORT CALL LADDER | |

|---|---|---|

|

|

|

| About Strategy |

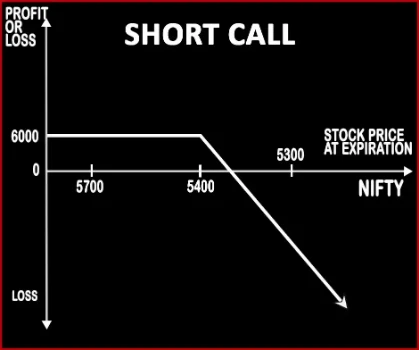

Short Call Option StrategyA trader shorts or writes a Call Option when he feels that underlying stock price is likely to go down. Selling Call Option is a strategy preferred for experienced traders. However this strategy is very risky in nature. If the stock rallies on the upside, your risk becomes potentially unquantifiable and unlimited. If the strategy |

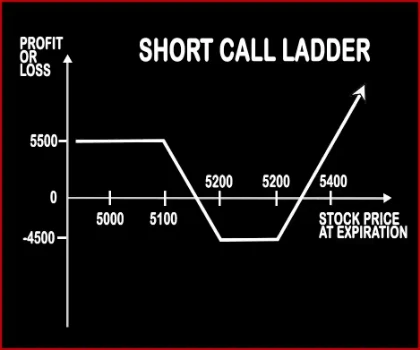

Short Call Ladder Option StrategyThis strategy is implemented when a trader is moderately bullish on the market, and volatility. It involves sale of an ITM Call Option, buying of an ATM Call Option & OTM Call Option. The risk associated with the strategy is limited. Risk:

|

SHORT CALL Vs SHORT CALL LADDER - Details

| SHORT CALL | SHORT CALL LADDER | |

|---|---|---|

| Market View | Bearish | Neutral |

| Type (CE/PE) | CE (Call Option) | CE (Call Option) |

| Number Of Positions | 1 | 3 |

| Strategy Level | Advance | Advance |

| Reward Profile | Limited | Unlimited |

| Risk Profile | Unlimited | Limited |

| Breakeven Point | Strike Price of Short Call + Premium Received | Upper Breakeven Point = Total Strike Prices of Long Calls - Strike Price of Short Call + Net Premium Received Lower Breakeven Point = Strike Price of Short Call - Net Premium Received |

SHORT CALL Vs SHORT CALL LADDER - When & How to use ?

| SHORT CALL | SHORT CALL LADDER | |

|---|---|---|

| Market View | Bearish | Neutral |

| When to use? | It is an aggressive strategy and involves huge risks. It should be used only in case where trader is certain about the bearish market view on the underlying. | This strategy is implemented when a trader is moderately bullish on the market, and volatility |

| Action | Sell or Write Call Option | Sell 1 ITM Call, Buy 1 ATM Call, Buy 1 OTM Call |

| Breakeven Point | Strike Price of Short Call + Premium Received | Upper Breakeven Point = Total Strike Prices of Long Calls - Strike Price of Short Call + Net Premium Received Lower Breakeven Point = Strike Price of Short Call - Net Premium Received |

SHORT CALL Vs SHORT CALL LADDER - Risk & Reward

| SHORT CALL | SHORT CALL LADDER | |

|---|---|---|

| Maximum Profit Scenario | Max Profit = Premium Received | Profit Achieved When Price of Underlying > Total Strike Prices of Long Calls - Strike Price of Short Call + Net Premium Received |

| Maximum Loss Scenario | Loss Occurs When Price of Underlying > Strike Price of Short Call + Premium Received | Strike Price of Lower Strike Long Call - Strike Price of Short Call - Net Premium Received + Commissions Paid |

| Risk | Unlimited | Limited |

| Reward | Limited | Unlimited |

SHORT CALL Vs SHORT CALL LADDER - Strategy Pros & Cons

| SHORT CALL | SHORT CALL LADDER | |

|---|---|---|

| Similar Strategies | Covered Put, Covered Calls | Short Put Ladder, Strip, Strap |

| Disadvantage | • Unlimited risk to the upside underlying stocks. • Potential loss more than the premium collected. | • Unlimited risk. • Margin required. |

| Advantages | • With the help of this strategy, traders can book profit from falling prices in the underlying asset. • Less investment, more profit. • Traders can book profit when underlying stock price fall, move sideways or rise by a small amount. | • Higher probability of profit. • Unlimited upside profit. • Limited maximum loss. |