Compare Strategies

| SHORT CALL LADDER | THE COLLAR | |

|---|---|---|

|

|

|

| About Strategy |

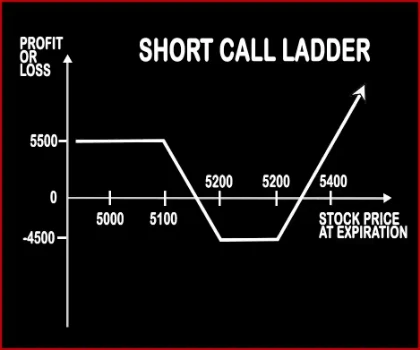

Short Call Ladder Option StrategyThis strategy is implemented when a trader is moderately bullish on the market, and volatility. It involves sale of an ITM Call Option, buying of an ATM Call Option & OTM Call Option. The risk associated with the strategy is limited. Risk:

|

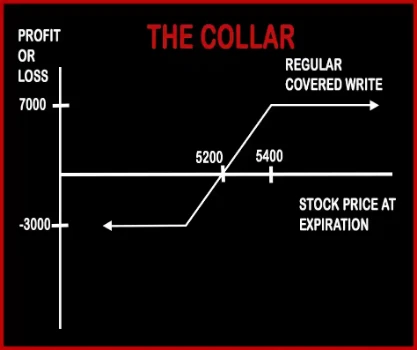

The Collar Option StrategyCollar Strategy is an extension to Covered Call Strategy. A trader, who is bullish in nature but has a very low risk appetite and wants to mitigate his risk will implement the Collar Strategy. Collar involves buying of stock in either Cash/Futures Market, buying an ATM Put Option & selling an OTM Call Option. The expiry dates of the op .. |

SHORT CALL LADDER Vs THE COLLAR - Details

| SHORT CALL LADDER | THE COLLAR | |

|---|---|---|

| Market View | Neutral | Bullish |

| Type (CE/PE) | CE (Call Option) | CE (Call Option) + PE (Put Option) + Underlying |

| Number Of Positions | 3 | 3 |

| Strategy Level | Advance | Advance |

| Reward Profile | Unlimited | Limited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Upper Breakeven Point = Total Strike Prices of Long Calls - Strike Price of Short Call + Net Premium Received Lower Breakeven Point = Strike Price of Short Call - Net Premium Received | Price of Features - Call Premium + Put Premium |

SHORT CALL LADDER Vs THE COLLAR - When & How to use ?

| SHORT CALL LADDER | THE COLLAR | |

|---|---|---|

| Market View | Neutral | Bullish |

| When to use? | This strategy is implemented when a trader is moderately bullish on the market, and volatility | It should be used only in case where trader is certain about the bearish market view. |

| Action | Sell 1 ITM Call, Buy 1 ATM Call, Buy 1 OTM Call | Buy Underlying, Buy 1 ATM Put Option, Sell 1 OTM Call Option |

| Breakeven Point | Upper Breakeven Point = Total Strike Prices of Long Calls - Strike Price of Short Call + Net Premium Received Lower Breakeven Point = Strike Price of Short Call - Net Premium Received | Price of Features - Call Premium + Put Premium |

SHORT CALL LADDER Vs THE COLLAR - Risk & Reward

| SHORT CALL LADDER | THE COLLAR | |

|---|---|---|

| Maximum Profit Scenario | Profit Achieved When Price of Underlying > Total Strike Prices of Long Calls - Strike Price of Short Call + Net Premium Received | Strike Price of Short Call - Purchase Price of Underlying + Net Premium Received |

| Maximum Loss Scenario | Strike Price of Lower Strike Long Call - Strike Price of Short Call - Net Premium Received + Commissions Paid | Purchase Price of Underlying - Strike Price of Long Put - Net Premium Received |

| Risk | Limited | Limited |

| Reward | Unlimited | Limited |

SHORT CALL LADDER Vs THE COLLAR - Strategy Pros & Cons

| SHORT CALL LADDER | THE COLLAR | |

|---|---|---|

| Similar Strategies | Short Put Ladder, Strip, Strap | Call Spread, Bull Put Spread |

| Disadvantage | • Unlimited risk. • Margin required. | • Limited profit. • A trader can book more profit without this strategy if the prices goes high. |

| Advantages | • Higher probability of profit. • Unlimited upside profit. • Limited maximum loss. | • This strategy protects the losses on underlying asset. • Risk gets limited if the price of the stocks goes down. • Trader can get ownership benefits life dividend and voting rights. |