Compare Strategies

| RATIO CALL WRITE | COVERED PUT | |

|---|---|---|

|

|

|

| About Strategy |

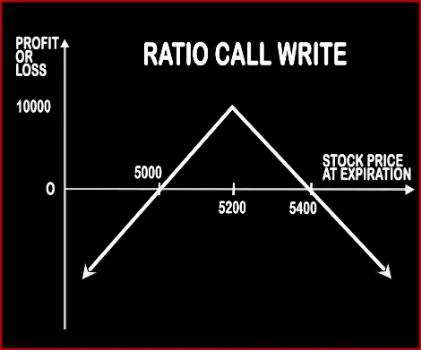

Ratio Call Write Option StrategyThis strategy involves buying of an underlying asset in the cash/futures market and simultaneously selling ATM Calls double the number of long quantity. This strategy is used by a trader who is neutral on the market and bearish on the volatility in the near future. Here profits will be capped up to the premium amount and risk will be potentially unlimited.

|

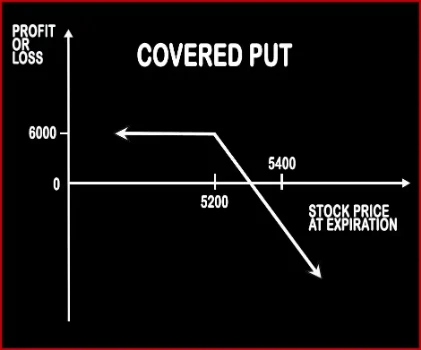

Covered Put Option StrategyThis strategy is exactly opposite to Covered Call Strategy. Here the investor is neutral or moderately bearish in nature and wants to take advantage of the price fall in the near future. The trader will short one lot of stock future. Now the trader will short ATM Put Option, the option strike price will be his exit price. If the prices rally above the strike price, the .. |

RATIO CALL WRITE Vs COVERED PUT - Details

| RATIO CALL WRITE | COVERED PUT | |

|---|---|---|

| Market View | Neutral | Bearish |

| Type (CE/PE) | CE (Call Option) | PE (Put Option) + Underlying |

| Number Of Positions | 2 | 2 |

| Strategy Level | Beginners | Advance |

| Reward Profile | Limited | Limited |

| Risk Profile | Unlimited | Unlimited |

| Breakeven Point | Upper Breakeven Point = Strike Price of Short Calls + Points of Maximum Profit, Lower Breakeven Point = Strike Price of Short Calls - Points of Maximum Profit | Futures Price + Premium Received |

RATIO CALL WRITE Vs COVERED PUT - When & How to use ?

| RATIO CALL WRITE | COVERED PUT | |

|---|---|---|

| Market View | Neutral | Bearish |

| When to use? | This strategy is used by a trader who is neutral on the market and bearish on the volatility in the near future. | The Covered Put works well when the market is moderately Bearish. |

| Action | Sell 2 ATM Calls | Sell Underlying Sell OTM Put Option |

| Breakeven Point | Upper Breakeven Point = Strike Price of Short Calls + Points of Maximum Profit, Lower Breakeven Point = Strike Price of Short Calls - Points of Maximum Profit | Futures Price + Premium Received |

RATIO CALL WRITE Vs COVERED PUT - Risk & Reward

| RATIO CALL WRITE | COVERED PUT | |

|---|---|---|

| Maximum Profit Scenario | Net Premium Received - Commissions Paid | The profit happens when the price of the underlying moves above strike price of Short Put. |

| Maximum Loss Scenario | Price of Underlying - Strike Price of Short Call - Net Premium Received OR Purchase Price of Underlying - Price of Underlying - Net Premium Received + Commissions Paid | Price of Underlying - Sale Price of Underlying - Premium Received |

| Risk | Unlimited | Unlimited |

| Reward | Limited | Limited |

RATIO CALL WRITE Vs COVERED PUT - Strategy Pros & Cons

| RATIO CALL WRITE | COVERED PUT | |

|---|---|---|

| Similar Strategies | Variable Ratio Write | Bear Put Spread, Bear Call Spread |

| Disadvantage | • Potential loss is higher than gain. • Limited profit. | • Limited profit, unlimited risk. • Trader should have enough experience before using this strategy. |

| Advantages | • Investors can book profit when underlying stock price drop, move sideways or rises by a small amount. • Able to generate monthly income. • Able to generate profit from fall in prices or mild increase in the prices. |