Compare Strategies

| CHRISTMAS TREE SPREAD WITH PUT OPTION | SHORT STRADDLE | |

|---|---|---|

|

|

|

| About Strategy |

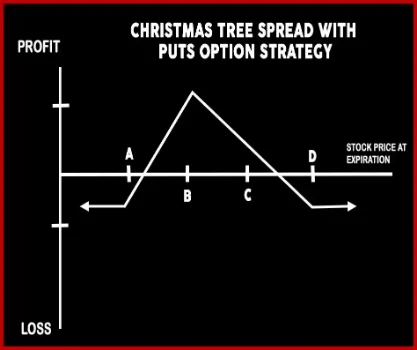

Christmas Tree Spread with Puts Option StrategyThis Strategy is an advance option strategy that consists of three legs and six total options. In this strategy buying one put at strike price D, skipping strike price C, writes three calls at strike price B, and buying two calls at strike price A for same expiration dates for neutral to bearish forecast. An investor used this strategy to potential returns |

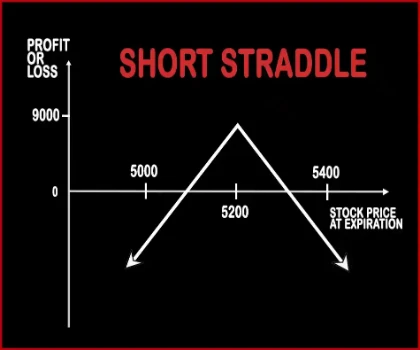

Short Straddle Option strategyThis strategy is just the opposite of Long Straddle. A trader should adopt this strategy when he expects less volatility in the near future. Here, a trader will sell one Call Option & one Put Option of the same strike price, same expiry date and of the same underlying asset. If the stock/index hovers around the same levels then both the options will expire worthless an .. |

CHRISTMAS TREE SPREAD WITH PUT OPTION Vs SHORT STRADDLE - Details

| CHRISTMAS TREE SPREAD WITH PUT OPTION | SHORT STRADDLE | |

|---|---|---|

| Market View | Bearish | Neutral |

| Type (CE/PE) | CE (Call Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 6 | 2 |

| Strategy Level | Advance | Advance |

| Reward Profile | Limited | Limited |

| Risk Profile | Limited | Unlimited |

| Breakeven Point | Lowest strike prices + the half premium – premium paid | Lower Breakeven = Strike Price of Put - Net Premium, Upper breakeven = Strike Price of Call+ Net Premium |

CHRISTMAS TREE SPREAD WITH PUT OPTION Vs SHORT STRADDLE - When & How to use ?

| CHRISTMAS TREE SPREAD WITH PUT OPTION | SHORT STRADDLE | |

|---|---|---|

| Market View | Bearish | Neutral |

| When to use? | This Strategy is used when an investor wants potential returns. | This strategy is work well when an investor expect a flat market in the coming days with very less movement in the prices of underlying asset. |

| Action | Buying one ATM, Selling 3 Puts, Buying one more OTM Put | Sell Call Option, Sell Put Option |

| Breakeven Point | Lowest strike prices + the half premium – premium paid | Lower Breakeven = Strike Price of Put - Net Premium, Upper breakeven = Strike Price of Call+ Net Premium |

CHRISTMAS TREE SPREAD WITH PUT OPTION Vs SHORT STRADDLE - Risk & Reward

| CHRISTMAS TREE SPREAD WITH PUT OPTION | SHORT STRADDLE | |

|---|---|---|

| Maximum Profit Scenario | Equal middle strike price – higher strike price – the premium | Max Profit = Net Premium Received - Commissions Paid |

| Maximum Loss Scenario | Net Debit paid for the strategy. | Maximum Loss = Long Call Strike Price - Short Call Strike Price - Net Premium Received |

| Risk | Limited | Unlimited |

| Reward | Limited | Limited |

CHRISTMAS TREE SPREAD WITH PUT OPTION Vs SHORT STRADDLE - Strategy Pros & Cons

| CHRISTMAS TREE SPREAD WITH PUT OPTION | SHORT STRADDLE | |

|---|---|---|

| Similar Strategies | Butterfly spreads | Short Strangle |

| Disadvantage | • Potential profit is lower or limited. | • Unlimited risk. • If the price of the underlying asset moves in either direction then huge losses can occur. |

| Advantages | • The potential of loss is limited. | • A trader can earn profit even when there is no volatility in the market . • Allows you to benefit from double time decay. • Trader can collect premium from puts and calls option . |