Compare Strategies

| REVERSE IRON BUTTERFLY | IRON CONDORS | |

|---|---|---|

|

|

|

| About Strategy |

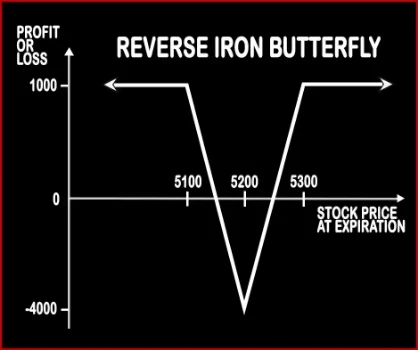

Reverse Iron Butterfly Option StrategyReverse Iron Butterfly as the name suggests is the opposite of Iron Butterfly. In Reverse Iron Butterfly, a trader is bullish on volatility and expects the market to make significant move in the near future in either directions. Here a trader will buy 1 ATM Call Option, sell 1 OTM Call Option, buy 1 ATM Put Option, sell 1 OTM Put Option. This strategy also bags lim |

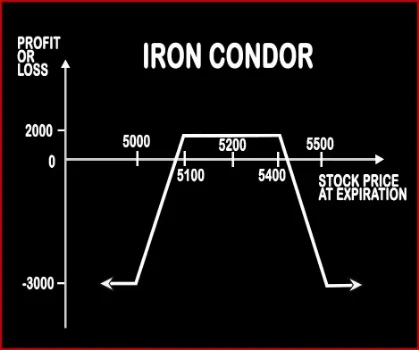

Iron Condors Option StrategyIron Condor is a neutral trading strategy. A trader tries to make profit from low volatility in the price of the underlying asset. This strategy will be better understood if you recall ‘Bull Put Spread’ & ‘Bear Call Spread’. A trader will buy one Deep OTM Put Option and sell one OTM Put Option,. He will also sell one OTM Call Option and buy one Deep OTM Call Option. .. |

REVERSE IRON BUTTERFLY Vs IRON CONDORS - Details

| REVERSE IRON BUTTERFLY | IRON CONDORS | |

|---|---|---|

| Market View | Neutral | Neutral |

| Type (CE/PE) | CE (Call Option) + PE (Put Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 4 | 4 |

| Strategy Level | Advance | Advance |

| Reward Profile | Limited | Limited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Upper Breakeven Point = Strike Price of Long Call + Net Premium Paid, Lower Breakeven Point = Strike Price of Long Put - Net Premium Paid | Upper Breakeven Point = Strike Price of Short Call + Net Premium Received, Lower Breakeven Point = Strike Price of Short Put - Net Premium Received |

REVERSE IRON BUTTERFLY Vs IRON CONDORS - When & How to use ?

| REVERSE IRON BUTTERFLY | IRON CONDORS | |

|---|---|---|

| Market View | Neutral | Neutral |

| When to use? | This strategy is used when a trader is bullish on volatility and expects the market to make significant move in the near future in either directions. | When a trader tries to make profit from low volatility in the price of the underlying asset. |

| Action | Sell 1 OTM Put, Buy 1 ATM Put, Buy 1 ATM Call, Sell 1 OTM Call | Sell 1 OTM Put, Buy 1 OTM Put (Lower Strike), Sell 1 OTM Call, Buy 1 OTM Call (Higher Strike) |

| Breakeven Point | Upper Breakeven Point = Strike Price of Long Call + Net Premium Paid, Lower Breakeven Point = Strike Price of Long Put - Net Premium Paid | Upper Breakeven Point = Strike Price of Short Call + Net Premium Received, Lower Breakeven Point = Strike Price of Short Put - Net Premium Received |

REVERSE IRON BUTTERFLY Vs IRON CONDORS - Risk & Reward

| REVERSE IRON BUTTERFLY | IRON CONDORS | |

|---|---|---|

| Maximum Profit Scenario | Strike Price of Short Call (or Long Put) - Strike Price of Long Call (or Short Put) - Net Premium Paid - Commissions Paid | Net Premium Received - Commissions Paid |

| Maximum Loss Scenario | Net Premium Paid + Commissions Paid | Strike Price of Long Call - Strike Price of Short Call - Net Premium Received + Commissions Paid |

| Risk | Limited | Limited |

| Reward | Limited | Limited |

REVERSE IRON BUTTERFLY Vs IRON CONDORS - Strategy Pros & Cons

| REVERSE IRON BUTTERFLY | IRON CONDORS | |

|---|---|---|

| Similar Strategies | Short Put Butterfly, Short Condor | Long Put Butterfly, Neutral Calendar Spread |

| Disadvantage | • Potential loss is higher than gain, complex strategy. • Not suitable for beginners. | • Full of risk. • Unlimited maximum loss. |

| Advantages | • Able to profit whether stocks move in either direction up or down. • This strategy can be used by option traders who cannot use credit spreads. • Predictable maximum loss and profits, volatile strategy. | • Chance to gather double premium. • Sure, maximum gains on one-half the trade. • Flexible and double leverage at half price. |