Compare Strategies

| SHORT CALL LADDER | LONG COMBO | |

|---|---|---|

|

|

|

| About Strategy |

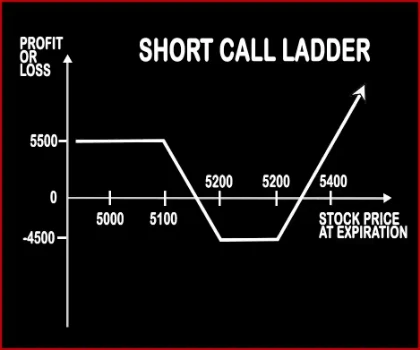

Short Call Ladder Option StrategyThis strategy is implemented when a trader is moderately bullish on the market, and volatility. It involves sale of an ITM Call Option, buying of an ATM Call Option & OTM Call Option. The risk associated with the strategy is limited. Risk:

|

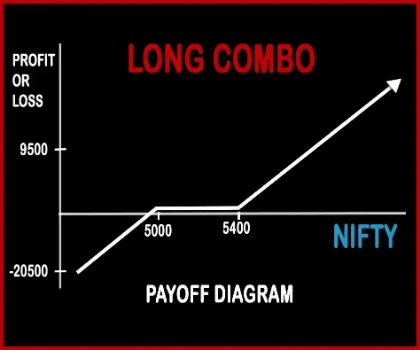

Long Combo Option StrategyLong Combo Option Trading Strategy is implemented when a trader is bullish in nature and expects the stock price to rise in the near future. Here a trader will sell one ‘Out of the Money’ Put Option and buy one ‘Out of the Money’ Call Option. This trade will require less capital to implement since the amount required to buy the call will be covered by the amount received .. |

SHORT CALL LADDER Vs LONG COMBO - Details

| SHORT CALL LADDER | LONG COMBO | |

|---|---|---|

| Market View | Neutral | Bullish |

| Type (CE/PE) | CE (Call Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 3 | 2 |

| Strategy Level | Advance | Advance |

| Reward Profile | Unlimited | Unlimited |

| Risk Profile | Limited | Unlimited |

| Breakeven Point | Upper Breakeven Point = Total Strike Prices of Long Calls - Strike Price of Short Call + Net Premium Received Lower Breakeven Point = Strike Price of Short Call - Net Premium Received | Call Strike + Net Premium |

SHORT CALL LADDER Vs LONG COMBO - When & How to use ?

| SHORT CALL LADDER | LONG COMBO | |

|---|---|---|

| Market View | Neutral | Bullish |

| When to use? | This strategy is implemented when a trader is moderately bullish on the market, and volatility | This strategy is used when an investor Bullish on an underlying but don't have the required capital or the risk appetite to invest directly into it. |

| Action | Sell 1 ITM Call, Buy 1 ATM Call, Buy 1 OTM Call | Sell OTM Put Option, Buy OTM Call Option |

| Breakeven Point | Upper Breakeven Point = Total Strike Prices of Long Calls - Strike Price of Short Call + Net Premium Received Lower Breakeven Point = Strike Price of Short Call - Net Premium Received | Call Strike + Net Premium |

SHORT CALL LADDER Vs LONG COMBO - Risk & Reward

| SHORT CALL LADDER | LONG COMBO | |

|---|---|---|

| Maximum Profit Scenario | Profit Achieved When Price of Underlying > Total Strike Prices of Long Calls - Strike Price of Short Call + Net Premium Received | Underlying asset goes up and Call option exercised |

| Maximum Loss Scenario | Strike Price of Lower Strike Long Call - Strike Price of Short Call - Net Premium Received + Commissions Paid | Underlying asset goes down and Put option exercised |

| Risk | Limited | Unlimited |

| Reward | Unlimited | Unlimited |

SHORT CALL LADDER Vs LONG COMBO - Strategy Pros & Cons

| SHORT CALL LADDER | LONG COMBO | |

|---|---|---|

| Similar Strategies | Short Put Ladder, Strip, Strap | - |

| Disadvantage | • Unlimited risk. • Margin required. | • Losses can keep on increasing as the price of stock goes down. • High risk strategy. |

| Advantages | • Higher probability of profit. • Unlimited upside profit. • Limited maximum loss. | • Capital investment is low and returns are high. • Unlimited reward, returns keep on increasing with the increase on stock price. • Leverage facility provided by this strategy is very beneficial. |