What is an Option: Features, Types, How it Works, and Example of an Option

What is an Option?

An option trading is a financial derivative that derives its value from an underlying asset, such as stocks, bonds, commodities, or indices. It provides the buyer, also known as the holder or the owner of the option, with the right, but not the obligation, to buy or sell the underlying asset at a predetermined price, known as the strike price, within a specific time period, known as the expiration date. An option chain contract is a type of financial agreement that grants an investor the choice to purchase or sell an asset at a prearranged price on or before a certain date. It provides the right to buy, but not the obligation to do so.

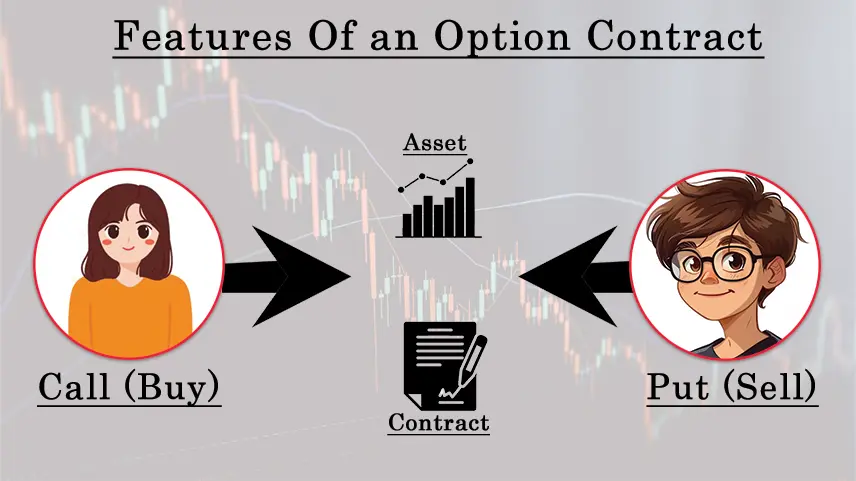

Features of an Option Contract

An option contract has several key features, including:

1. Underlying Asset: Every option contract is based on an underlying asset, which can be a stock, index, currency, commodity, or other financial instrument. The value and performance of the option contract depend on the movement of this underlying asset.

2. Call or Put Option: An option analysis contract can be either a call option or a put option. A call option gives the holder the right to buy the underlying asset at a specified price (strike price) within a specific time period. A put option, on the other hand, gives the holder the right to sell the underlying asset at the strike price within the designated time frame.

3. Strike Price: The strike price is the predetermined price at which the underlying asset can be bought or sold when the option is exercised. It is specified in the option contract and remains fixed throughout the contract's duration.

4. Expiration Date: Every option contract has an expiration date, also known as the maturity date. This is the deadline by which the option must be exercised or it becomes worthless. After the expiration date, the option can no longer be traded or exercised.

5. Premium: To acquire an option contract, the buyer pays a premium to the seller. The premium is the price of the option and represents the buyer's cost for holding the right to buy or sell the underlying asset. The premium is influenced by factors such as the current market price of the underlying asset, volatility, time to expiration, and interest rates.

6. Rights, not Obligations: One important feature of option contracts is that they grant the holder the right to buy or sell the underlying asset but not the obligation to do so. The holder can choose to exercise the option if it is advantageous, or let it expire if it is not.

7. Flexibility: Options offer flexibility to investors, as they can be bought or sold on exchanges before the expiration date. This allows for various trading strategies, including hedging against price fluctuations, speculation on future movements, and generating income through option writing.

Types of Options

There are several types of options, option types each with its own characteristics and purposes. The main types of options include: Basic types of options

1. Call Options: A call option gives the holder the right to buy the underlying asset at the strike price before or on the expiration date. Call options are typically used by investors who anticipate an increase in the price of the underlying asset.

2. Put Options: A put option gives the holder the right to sell the underlying asset at the strike price before or on the expiration date. Put options are commonly used as a hedging tool or by investors who expect the price of the underlying asset to decrease.

3. American Options: An American option allows the holder to exercise the option at any time before the expiration date. This flexibility adds value to the option, but it also increases its price compared to similar European options.

4. European Options: A European option can only be exercised on the expiration date, not before. European options are typically traded on organized exchanges.

5. Stock Options: Stock options are options contracts where the underlying asset is an individual stock. These are widely used in employee compensation plans, such as employee stock option programs (ESOPs).

6. Index Options: Index options are based on a stock market index, such as the S&P 500 or the Dow Jones Industrial Average (DJIA). They provide exposure to the performance of an entire index rather than an individual stock.

7. Currency Options: Currency options, also known as forex options, give the holder the right to buy or sell a specific amount of one currency for another at a predetermined exchange rate within a specified time period.

8. Futures Options: Futures options are options contracts based on futures contracts. They allow the holder to buy or sell a futures contract at a predetermined price within a specific time frame.

How options work

Options work by providing investors and traders with the opportunity to speculate on the price movements of underlying assets or manage risk in their investment portfolios. When an individual purchases an option contract, they are essentially buying the right, but not the obligation, to either buy (call option) or sell (put option) the underlying asset at a predetermined price (strike price) within a specific timeframe (expiration date).

If an investor holds a call option, they expect the price of the underlying asset to rise. If the price does indeed increase above the strike price, the investor can exercise the call option, buying the asset at the strike price and potentially profiting from the price difference. However, if the price remains below the strike price, the investor is not obligated to exercise the option and can let it expire.

Conversely, if an investor holds a put option chart, they anticipate the price of the underlying asset to decrease. If the price falls below the strike price, the investor can exercise the put option data, selling the asset at the strike price and potentially benefiting from the price difference. If the price remains above the strike price, the investor is not obliged to exercise the option and can let it expire.

Options provide flexibility as they can be bought and sold on exchanges before the expiration date. Investors can close their positions by selling the options they hold, even if they have not reached the expiration date. Additionally, options can be used for various trading strategies, including hedging against market volatility, speculating on price movements, generating income through option writing, or implementing complex options spreads to manage risk and optimize returns.

Example of an Option

An example of an option is a call option on Company XYZ stock with a strike price of ₹2,000 and an expiration date of one month from now. If an investor purchases this call option, they have the right, but not the obligation, to buy Company XYZ stock at ₹2,000 per share within the next month. If the stock price rises above ₹2,000, the investor can exercise the option and buy the stock at the predetermined price, potentially profiting from the price difference. However, if the stock price remains below ₹2,000 or decreases, the investor is not obligated to exercise the option and can let it expire.

0 comments